levofloxacinstarry

starry 时间:2021-01-09 阅读:()

RegulatoryStoryGotomarketnewssectionCompanyCathayInternationalHoldingsLdTIDMCTIHeadlineZhejiangStarryPharmaceuticalCo.

,Ltd.

Released07:0016-Nov-2010Number2440W07RNSNumber:2440WCathayInternationalHoldingsLd16November2010CATHAYINTERNATIONALHOLDINGSLIMITEDProposedminorityinvestmentinZhejiangStarryPharmaceuticalCo.

,Ltd.

('Starry')CathayInternationalHoldingsLtd.

(LSE:CTI.

L)('Cathay'orthe'Company'),acompanyinvestingprimarilyinthegrowingpharmaceuticalandhealthcaresectorsinthePeople'sRepublicofChina('PRC'),announcestodaythat:·LansenPharmaceuticalHoldingsLimited(HKE:503.

HK)('Lansen'),theCompany'ssubsidiarylistedonthemainboardoftheHongKongExchange,hasannouncedtodaythatithasagreedthetermsforthepurchaseofa20%equityinterestinStarry('Lansen'sInvestment')fromanindependentthirdpartyforacashconsiderationofapproximatelyUS$24million;and·theCompanyhasagreedthetermsforthepurchaseofa1.

5%equityinterestinStarry(the'Company'sInvestment')fromthesameindependentthirdpartyforacashconsiderationofapproximatelyUS$1.

8million.

DetailsofthetransactionLansen'sInvestmentistobeeffectedpursuanttoanequitytransferagreement(the'LansenAgreement')underwhichLansenInvestments(HongKong)Limited('LSI'),anindirectwhollyownedsubsidiaryofLansen,hasagreedtopurchaseandMr.

LiewYewThoong(the'Vendor'),oneoftheexistingminorityshareholdersofStarry,hasagreedtosell,20%oftheregisteredcapitalofStarryforacashconsiderationofapproximatelyUS$24million(RMB160million).

TheCompany'sInvestmentistobeeffectedpursuanttoaseparateequitytransferagreement(the'CathayAgreement')underwhichFullKeenLimited('FKL')anindirectwholly-ownedsubsidiaryoftheCompany,hasagreedtopurchaseandtheVendorhasagreedtosell,1.

5%oftheregisteredcapitalofStarryforacashconsiderationofapproximatelyUS$1.

8million(RMB12million).

ZhejiangStarryPharmaceuticalCo.

,Ltd.

-LondonStockExchangehttp://www.

londonstockexchange.

com/exchange/news/market-news/mar.

.

.

1of411/16/20103:03PMInformationonStarryStarryisasino-foreignequityjointventureincorporatedunderthelawsofthePRC.

Itisacompanyspecializingintheproductionofbulkpharmaceuticalsandintermediates.

ThetwocorebulkpharmaceuticalproductsofStarryareiohexolforX-CTnon-ioniccontrastagentsandlevofloxacinforantibiotics.

StarryisthelargestiohexolmanufacturerinthePRCandisexperiencedintheproductionmanagementandqualitycontrolofbulkpharmaceuticals.

SetoutbelowisasummaryoftheauditedfinancialresultsofStarryforthetwoyearsended31December2008and31December2009,whichwerepreparedinaccordancewiththePRCgenerallyacceptedaccountingprinciples:Yearended31December20092008EquivalentEquivalentRMB'000US$'000RMB'000US$'000Profitbeforetaxation57,9748,72532,8604,945Profitaftertaxation57,9748,72532,8604,945Grossassets549,49182,698467,79470,403Netassets199,70730,056139,05320,927ConsiderationTheconsiderationforLansen'sInvestmentisRMB160million(approximatelyUS$24million),whichshallbefundedthroughtheexistinginternalresourcesoftheLansengroup.

TheconsiderationfortheCompany'sInvestmentisRMB12million(approximatelyUS$1.

8million).

TheconsiderationwillbesatisfiedoutoftheCompany'sinternalresources.

Theconsiderationwasagreedafterarm'slengthnegotiationsbetweenLansen,theCompanyandtheVendor,takingintoconsideration,amongstotherthings,(i)thenetassetvalueofStarryasat31December2009;(ii)futureprospectsofthebusinessofStarry;(iii)theprospectsofthepharmaceuticalindustryinthePRCasawhole;and(iv)tradingpriceearningsmultiplesofStarry'smarketcomparablesinthePRC.

TheconsiderationpayablefortheCompany'sInvestmentandLansen'sInvestmentshallbesettledwithin10businessdaysofreceiptoftherelevantgovernmentapprovalinthePRCforthetransferoftheequityinterestsundertherespectiveagreement.

Iftherelevantgovernmentapprovalforthetransferoftheequityinterestsisnotreceivedwithin60daysfromthedateoftheapplicationforapproval(orsuchotherdateastheVendorandLSIorFKL,asthecasemaybe,mayagree)theLansenAgreementandtheCathayAgreementshalllapseandbeofnofurtherforceandeffect.

EffectofthetransactionontheCathaygroupandbenefitsofthetransactionThereasonsforandexpectedbenefitsofLansen'sInvestmentincludethefollowingmatters:·OneofLansen'sstrategiesistoexploreopportunities,throughbusinessalliancesoracquisitions,whichwouldexpanditsproductrangeofrheumaticspecialtydrugs,includingtheupstreambulkpharmaceuticalproductionforrheumaticspecialtydrugs.

TheboardofLansenbelievesthatLansen'sInvestmentprovidesLansenwithopportunitiestoparticipateintheupstreamZhejiangStarryPharmaceuticalCo.

,Ltd.

-LondonStockExchangehttp://www.

londonstockexchange.

com/exchange/news/market-news/mar.

.

.

2of411/16/20103:03PMsupplybusinessinthepharmaceuticalindustryvaluechain.

Lansen'sInvestmentisofstrategicsignificancesinceLansen'sInvestmentwillallowittodevelopexperienceintheproductionmanagementandcontrolofbulkpharmaceuticalsforitsdrugsinthefuture.

·Theimpactonbulkpharmaceuticalsappeartobelesssubstantialthantheimpactondownstreampharmaceuticalproductsundertherecent"DrugPriceControlMeasures"discussionpaperpublishedbythePRCgovernment.

Lansen'sInvestmentwillachieveacertaindegreeofdiversificationofproductconcentrationrisk.

·Lansen'sboardbelievesthatLansen'sInvestmentisconsistentwithLansen'sbusinessobjectiveofestablishingandstrengtheningbusinessallianceswithpharmaceuticalcompanies.

LansenwillbenefitfromStarry'sexperienceinareasincludingrawmaterialsproductiontechnology,GMPcertification,costandqualitycontrol,andenvironmentalprotection.

LansenisnotexpectedtodevotesignificanthumanandmanagementresourcestoStarry'soperations.

·Lansen'sboardconsidersthatthetermsandconditionsoftheLansenAgreement,includingtheconsiderationthereof,arefairandreasonableandthattheenteringintooftheLansenAgreementisintheinterestsofLansenanditsshareholdersasawhole.

ForCathay,theCompany'sInvestmentisinlinewiththeintentionstatedintheCompany's2010interimreporttospecializeinthefastgrowingpharmaceutical,healthcareandenvironmentprotectionmarketsandtowidentheinvestmentscopeoftheCathayGrouptoincludepotentialminorityinvestmentpositions.

TheBoardofCathayconsidersthatthetermsandconditionsoftheCathayAgreement,includingtheconsiderationthereof,arefairandreasonableandthattheenteringintooftheCathayAgreementisintheinterestsoftheCompanyanditsshareholdersasawhole.

DetailsofkeyindividualsimportanttothebusinessofStarryMr.

HuJinsheng,56,founderandoneofthemajorshareholdersofStarry,hasbeeninthebusinessforthirtyyearsandpossessesextensiveexperienceinoperationalandfinancialmanagementissues.

Mr.

HuJinshengistheGeneralManagerofStarry.

Mr.

HuJian,thesonofMr.

HuJinsheng,isanothermajorshareholderofStarry.

Mr.

HuJianistheDeputyGeneralManagerofStarry.

EnquiriesCathayInternationalHoldingsLimited+85228289289JinyiLee/EricSiuBrunswick+44(0)2074045959JonColesCertainstatementsinthisannouncementareforward-lookingstatements.

ThesestatementsrelatetotheCathayGroup'sfutureprospects,developmentsandbusinessstrategies.

Forward-lookingstatementsareidentifiedbytheiruseoftermsandphrasessuchas"believe","could","envisage","estimate","intend","may","plan","will"orthenegativeofthose,variationsorcomparableexpressions,includingreferencestoassumptions.

Theforward-lookingstatementsinthisannouncementarebasedoncurrentexpectationsandaresubjecttorisksanduncertaintiesthatcouldcauseactualresultstodiffermateriallyfromthoseexpressedorimpliedbythosestatements.

Giventheserisksanduncertainties,potentialinvestorsshouldnotplaceanyrelianceonforward-lookingZhejiangStarryPharmaceuticalCo.

,Ltd.

-LondonStockExchangehttp://www.

londonstockexchange.

com/exchange/news/market-news/mar.

.

.

3of411/16/20103:03PMstatements.

Theseforward-lookingstatementsspeakonlyasatthedateofthisannouncement.

NeithertheDirectorsnortheCompanyundertakeanyobligationtoupdateforward-lookingstatementsotherthanasrequiredbytheListingRules,DisclosureandTransparencyRules,applicablelegislationorbytherulesofanyothersecuritiesregulatoryauthority,whetherasaresultofnewinformation,futureeventsorotherwise.

ThisinformationisprovidedbyRNSThecompanynewsservicefromtheLondonStockExchangeENDMSCDMMMMVVRGGZGLondonStockExchangeplcisnotresponsibleforanddoesnotcheckcontentonthisWebsite.

Websiteusersareresponsibleforcheckingcontent.

Anynewsitem(includinganyprospectus)whichisaddressedsolelytothepersonsandcountriesspecifiedthereinshouldnotberelieduponotherthanbysuchpersonsand/oroutsidethespecifiedcountries.

Termsandconditions,includingrestrictionsonuseanddistributionapply.

2009LondonStockExchangeplc.

AllrightsreservedRegulatoryZhejiangStarryPharmaceuticalCo.

,Ltd.

-LondonStockExchangehttp://www.

londonstockexchange.

com/exchange/news/market-news/mar.

.

.

4of411/16/20103:03PM

,Ltd.

Released07:0016-Nov-2010Number2440W07RNSNumber:2440WCathayInternationalHoldingsLd16November2010CATHAYINTERNATIONALHOLDINGSLIMITEDProposedminorityinvestmentinZhejiangStarryPharmaceuticalCo.

,Ltd.

('Starry')CathayInternationalHoldingsLtd.

(LSE:CTI.

L)('Cathay'orthe'Company'),acompanyinvestingprimarilyinthegrowingpharmaceuticalandhealthcaresectorsinthePeople'sRepublicofChina('PRC'),announcestodaythat:·LansenPharmaceuticalHoldingsLimited(HKE:503.

HK)('Lansen'),theCompany'ssubsidiarylistedonthemainboardoftheHongKongExchange,hasannouncedtodaythatithasagreedthetermsforthepurchaseofa20%equityinterestinStarry('Lansen'sInvestment')fromanindependentthirdpartyforacashconsiderationofapproximatelyUS$24million;and·theCompanyhasagreedthetermsforthepurchaseofa1.

5%equityinterestinStarry(the'Company'sInvestment')fromthesameindependentthirdpartyforacashconsiderationofapproximatelyUS$1.

8million.

DetailsofthetransactionLansen'sInvestmentistobeeffectedpursuanttoanequitytransferagreement(the'LansenAgreement')underwhichLansenInvestments(HongKong)Limited('LSI'),anindirectwhollyownedsubsidiaryofLansen,hasagreedtopurchaseandMr.

LiewYewThoong(the'Vendor'),oneoftheexistingminorityshareholdersofStarry,hasagreedtosell,20%oftheregisteredcapitalofStarryforacashconsiderationofapproximatelyUS$24million(RMB160million).

TheCompany'sInvestmentistobeeffectedpursuanttoaseparateequitytransferagreement(the'CathayAgreement')underwhichFullKeenLimited('FKL')anindirectwholly-ownedsubsidiaryoftheCompany,hasagreedtopurchaseandtheVendorhasagreedtosell,1.

5%oftheregisteredcapitalofStarryforacashconsiderationofapproximatelyUS$1.

8million(RMB12million).

ZhejiangStarryPharmaceuticalCo.

,Ltd.

-LondonStockExchangehttp://www.

londonstockexchange.

com/exchange/news/market-news/mar.

.

.

1of411/16/20103:03PMInformationonStarryStarryisasino-foreignequityjointventureincorporatedunderthelawsofthePRC.

Itisacompanyspecializingintheproductionofbulkpharmaceuticalsandintermediates.

ThetwocorebulkpharmaceuticalproductsofStarryareiohexolforX-CTnon-ioniccontrastagentsandlevofloxacinforantibiotics.

StarryisthelargestiohexolmanufacturerinthePRCandisexperiencedintheproductionmanagementandqualitycontrolofbulkpharmaceuticals.

SetoutbelowisasummaryoftheauditedfinancialresultsofStarryforthetwoyearsended31December2008and31December2009,whichwerepreparedinaccordancewiththePRCgenerallyacceptedaccountingprinciples:Yearended31December20092008EquivalentEquivalentRMB'000US$'000RMB'000US$'000Profitbeforetaxation57,9748,72532,8604,945Profitaftertaxation57,9748,72532,8604,945Grossassets549,49182,698467,79470,403Netassets199,70730,056139,05320,927ConsiderationTheconsiderationforLansen'sInvestmentisRMB160million(approximatelyUS$24million),whichshallbefundedthroughtheexistinginternalresourcesoftheLansengroup.

TheconsiderationfortheCompany'sInvestmentisRMB12million(approximatelyUS$1.

8million).

TheconsiderationwillbesatisfiedoutoftheCompany'sinternalresources.

Theconsiderationwasagreedafterarm'slengthnegotiationsbetweenLansen,theCompanyandtheVendor,takingintoconsideration,amongstotherthings,(i)thenetassetvalueofStarryasat31December2009;(ii)futureprospectsofthebusinessofStarry;(iii)theprospectsofthepharmaceuticalindustryinthePRCasawhole;and(iv)tradingpriceearningsmultiplesofStarry'smarketcomparablesinthePRC.

TheconsiderationpayablefortheCompany'sInvestmentandLansen'sInvestmentshallbesettledwithin10businessdaysofreceiptoftherelevantgovernmentapprovalinthePRCforthetransferoftheequityinterestsundertherespectiveagreement.

Iftherelevantgovernmentapprovalforthetransferoftheequityinterestsisnotreceivedwithin60daysfromthedateoftheapplicationforapproval(orsuchotherdateastheVendorandLSIorFKL,asthecasemaybe,mayagree)theLansenAgreementandtheCathayAgreementshalllapseandbeofnofurtherforceandeffect.

EffectofthetransactionontheCathaygroupandbenefitsofthetransactionThereasonsforandexpectedbenefitsofLansen'sInvestmentincludethefollowingmatters:·OneofLansen'sstrategiesistoexploreopportunities,throughbusinessalliancesoracquisitions,whichwouldexpanditsproductrangeofrheumaticspecialtydrugs,includingtheupstreambulkpharmaceuticalproductionforrheumaticspecialtydrugs.

TheboardofLansenbelievesthatLansen'sInvestmentprovidesLansenwithopportunitiestoparticipateintheupstreamZhejiangStarryPharmaceuticalCo.

,Ltd.

-LondonStockExchangehttp://www.

londonstockexchange.

com/exchange/news/market-news/mar.

.

.

2of411/16/20103:03PMsupplybusinessinthepharmaceuticalindustryvaluechain.

Lansen'sInvestmentisofstrategicsignificancesinceLansen'sInvestmentwillallowittodevelopexperienceintheproductionmanagementandcontrolofbulkpharmaceuticalsforitsdrugsinthefuture.

·Theimpactonbulkpharmaceuticalsappeartobelesssubstantialthantheimpactondownstreampharmaceuticalproductsundertherecent"DrugPriceControlMeasures"discussionpaperpublishedbythePRCgovernment.

Lansen'sInvestmentwillachieveacertaindegreeofdiversificationofproductconcentrationrisk.

·Lansen'sboardbelievesthatLansen'sInvestmentisconsistentwithLansen'sbusinessobjectiveofestablishingandstrengtheningbusinessallianceswithpharmaceuticalcompanies.

LansenwillbenefitfromStarry'sexperienceinareasincludingrawmaterialsproductiontechnology,GMPcertification,costandqualitycontrol,andenvironmentalprotection.

LansenisnotexpectedtodevotesignificanthumanandmanagementresourcestoStarry'soperations.

·Lansen'sboardconsidersthatthetermsandconditionsoftheLansenAgreement,includingtheconsiderationthereof,arefairandreasonableandthattheenteringintooftheLansenAgreementisintheinterestsofLansenanditsshareholdersasawhole.

ForCathay,theCompany'sInvestmentisinlinewiththeintentionstatedintheCompany's2010interimreporttospecializeinthefastgrowingpharmaceutical,healthcareandenvironmentprotectionmarketsandtowidentheinvestmentscopeoftheCathayGrouptoincludepotentialminorityinvestmentpositions.

TheBoardofCathayconsidersthatthetermsandconditionsoftheCathayAgreement,includingtheconsiderationthereof,arefairandreasonableandthattheenteringintooftheCathayAgreementisintheinterestsoftheCompanyanditsshareholdersasawhole.

DetailsofkeyindividualsimportanttothebusinessofStarryMr.

HuJinsheng,56,founderandoneofthemajorshareholdersofStarry,hasbeeninthebusinessforthirtyyearsandpossessesextensiveexperienceinoperationalandfinancialmanagementissues.

Mr.

HuJinshengistheGeneralManagerofStarry.

Mr.

HuJian,thesonofMr.

HuJinsheng,isanothermajorshareholderofStarry.

Mr.

HuJianistheDeputyGeneralManagerofStarry.

EnquiriesCathayInternationalHoldingsLimited+85228289289JinyiLee/EricSiuBrunswick+44(0)2074045959JonColesCertainstatementsinthisannouncementareforward-lookingstatements.

ThesestatementsrelatetotheCathayGroup'sfutureprospects,developmentsandbusinessstrategies.

Forward-lookingstatementsareidentifiedbytheiruseoftermsandphrasessuchas"believe","could","envisage","estimate","intend","may","plan","will"orthenegativeofthose,variationsorcomparableexpressions,includingreferencestoassumptions.

Theforward-lookingstatementsinthisannouncementarebasedoncurrentexpectationsandaresubjecttorisksanduncertaintiesthatcouldcauseactualresultstodiffermateriallyfromthoseexpressedorimpliedbythosestatements.

Giventheserisksanduncertainties,potentialinvestorsshouldnotplaceanyrelianceonforward-lookingZhejiangStarryPharmaceuticalCo.

,Ltd.

-LondonStockExchangehttp://www.

londonstockexchange.

com/exchange/news/market-news/mar.

.

.

3of411/16/20103:03PMstatements.

Theseforward-lookingstatementsspeakonlyasatthedateofthisannouncement.

NeithertheDirectorsnortheCompanyundertakeanyobligationtoupdateforward-lookingstatementsotherthanasrequiredbytheListingRules,DisclosureandTransparencyRules,applicablelegislationorbytherulesofanyothersecuritiesregulatoryauthority,whetherasaresultofnewinformation,futureeventsorotherwise.

ThisinformationisprovidedbyRNSThecompanynewsservicefromtheLondonStockExchangeENDMSCDMMMMVVRGGZGLondonStockExchangeplcisnotresponsibleforanddoesnotcheckcontentonthisWebsite.

Websiteusersareresponsibleforcheckingcontent.

Anynewsitem(includinganyprospectus)whichisaddressedsolelytothepersonsandcountriesspecifiedthereinshouldnotberelieduponotherthanbysuchpersonsand/oroutsidethespecifiedcountries.

Termsandconditions,includingrestrictionsonuseanddistributionapply.

2009LondonStockExchangeplc.

AllrightsreservedRegulatoryZhejiangStarryPharmaceuticalCo.

,Ltd.

-LondonStockExchangehttp://www.

londonstockexchange.

com/exchange/news/market-news/mar.

.

.

4of411/16/20103:03PM

- levofloxacinstarry相关文档

- 浙江司太立制药股份有限公司

- 河南大学第三届

- Worldstarry

- 香港starry

- 股份starry

- 2Y-Chem,Ltd.药源药物化学(上海)有限公司

Megalayer新加坡服务器国际带宽线路测评

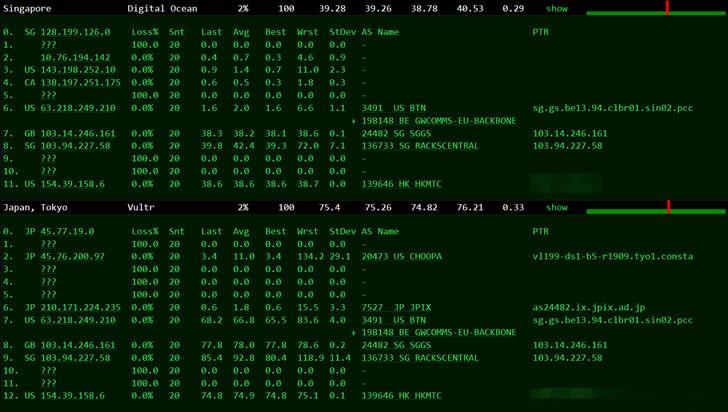

前几天有关注到Megalayer云服务器提供商有打算在月底的时候新增新加坡机房,这个是继美国、中国香港、菲律宾之外的第四个机房。也有工单询问到官方,新加坡机房有包括CN2国内优化线路和国际带宽,CN2优化线路应该是和菲律宾差不多的。如果我们追求速度和稳定性的中文业务,建议还是选择CN2优化带宽的香港服务器。这里有要到Megalayer新加坡服务器国际带宽的测试服务器,E3-1230配置20M国际带...

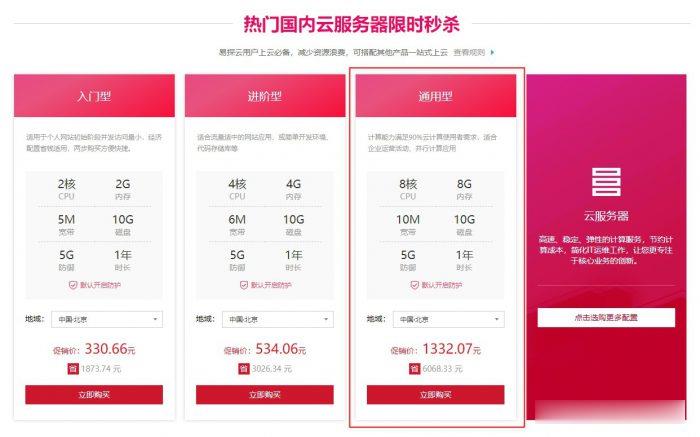

易探云(QQ音乐绿钻)北京/深圳云服务器8核8G10M带宽低至1332.07元/年起

易探云怎么样?易探云香港云服务器比较有优势,他家香港BGP+CN2口碑不错,速度也很稳定。尤其是今年他们动作很大,推出的香港云服务器有4个可用区价格低至18元起,试用过一个月的用户基本会续费,如果年付的话还可以享受8.5折或秒杀价格。今天,云服务器网(yuntue.com)小编推荐一下易探云国内云服务器优惠活动,北京和深圳这二个机房的云服务器2核2G5M带宽低至330.66元/年,还有高配云服务器...

美国高防云服务器 1核 1G 10M 38元/月 百纵科技

百纵科技:美国云服务器活动重磅来袭,洛杉矶C3机房 带金盾高防,会员后台可自助管理防火墙,添加黑白名单 CC策略开启低中高.CPU全系列E52680v3 DDR4内存 三星固态盘列阵。另有高防清洗!百纵科技官网:https://www.baizon.cn/联系QQ:3005827206美国洛杉矶 CN2 云服务器CPU内存带宽数据盘防御价格活动活动地址1核1G10M10G10G38/月续费同价点击...

starry为你推荐

-

虚拟主机服务什么是虚拟主机?便宜的虚拟主机哪里有便宜的国内虚拟主机?美国服务器托管美国网站服务器去哪里租?域名申请申请域名需要什么条件?具体点!急!急!!!网站空间商个人网站备案如何从空间商到备案山东虚拟主机能否在虚拟机与主机之间建立局域网,让主机与虚拟机同时上网?广西虚拟主机网站icp备案流程双线虚拟主机双线虚拟主机是智能的吗m3型虚拟主机谁在用中国万网M3虚拟主机?怎么样?www二级域名www的域名是一级域名还是二级域名