strategicsns

sns平台 时间:2021-02-12 阅读:()

BOCIresearchisavailableelectronicallyonBloomberg(BOCR),thomsonreuters.

comandwww.

bociresearch.

com.

CompanyUpdate9May2011-13%sideSELLTargetPrice:HK$185.

0Prior:SELLPriorTP:HK$185.

0700HKPrice:HK$211.

6TPBasis:28xP/Ebasedon2011ESectorRating:NEUTRALWhereareweDifferentOurfull-yearEPSestimateiscloseto9%belowconsensuswith1QNP4%lowerandrevenue3%lower.

KeyHighlightsofthisReport1Q11ErevenueYoYgrowthof35%.

1Q11EnetprofitYoYgrowthof29%.

KeyCatalysts/Events1Q11results–11May.

TradingSummaryP-TencentHoldings(700HK)110130150170190210230250721021121221328292142PriceCloseRelativetoHSCEI(RHS)Source:Bloomberg.

10203040May-10Jul-10Sep-10Nov-10Jan-11Mar-11May-11VolthYTD1M3M12MAbsolute(%)25.

33.

31.

536.

4RelativetoHSCEI(%)24.

19.

20.

424.

2Sharesoutstanding1,817Freefloat48.

0%Marketcap.

(HK$m)388,724Dailyturnover(3Mavg.

)HK$1,213mNetdebt/EquityNetcashMajorshareholderNaspers35%TencentHoldings1Q11resultspreviewWeexpectTencent's1Q11toplinetoreachRMB5.

709bn(up35%YoY)andtocontribute22%ofourfull-yearestimate.

Whileourrevenueforecastis3%lowerthanconsensus,weexpectthe1Q11bottomlinetocomeinatRMB2.

292bnon29%YoYgrowth,whichis4%lowerthanconsensus.

1Q11ResultsPreviewInternetvalue-addedservices:Onlinegamingrevenueisexpectedtogrow48%YoYandcommunityVAS22%YoY.

ThegrowthstemsfromtheincreaseinpayingsubscribersandtheimprovedARPU.

Mobileandtelecommunicationsvalue-addedservices:MVASisexpectedtopostyear-on-yeargrowthof26%,whichisbasedontheassumptionofpositivepayingsubscriberadditionsandARPU.

Onlineadvertising:20%YoYrevenuegrowthforthequarterisexpectedtoresultfromthecompany'scontinuouslygrowingsearch-basedadvertisingandstableIMandportalchannels.

Keypointstowatch:Newgamessources,SNSandopen-platformdevelopment.

KeyRiskstoRatingRapidmonetisationofitsSNSplatformsandchangeinitsIVASAPRUstrategy.

ValuationWereaffirmourSELLratingandtargetpriceofHK$185.

00,asweseeunattractiveriskrewardprofileaheadofresults.

MarketconsensusseemstopriceinaggressiveIVASandMVASgrowthinbothpayingsubscribernumbersandARPUwhichwebelieveisdifficultfortheCompanytobeat.

Our3-yearearningsCAGRfor2011-13Eis26%,whichimpliesaPEGratioof1.

08x.

BOCIResearchLimitedChina:TechnologyMichaelMeng(852)39886433michael.

meng@bocigroup.

comJohnieHu(852)39886437johnie.

hu@bocigroup.

comInvestmentSummary12-0912-1012-11E12-12E12-13ETotalturnover(RMBm)12,44019,64625,88833,20541,461Revenuegrowth73.

9%57.

9%31.

8%28.

3%24.

9%Netprofit(RMBm)5,1568,05410,32813,35516,174FullydilutedEPS(RMB)2.

794.

335.

517.

078.

50FDP/E(x)63.

3440.

8532.

0925.

0020.

79FDEPSgrowth84.

3%55.

1%27.

3%28.

4%20.

2%PreviousEPS(RMB)NANANANANAConsensusEPS(RMB)6.

047.

689.

57EPSvsConsensus(8.

8%)(7.

9%)(11.

1%)RecurrentCPS(RMB)4.

666.

787.

059.

5710P/CF(x)37.

9226.

0825.

0618.

4716.

84EV/EBITDA(x)45.

9527.

9622.

6817.

0313.

44Dividend/share(RMB)0.

400.

550.

710.

911.

10Dividendyield0.

23%0.

31%0.

40%0.

52%0.

62%ROE53.

7%47.

5%39.

3%36.

4%32.

5%.

50Source:Companydata,Bloombergdata,BOCIResearchestimates.

Closingpricesareasof6May2011.

TencentHoldingsPrice:HK$211.

6SELLTargetPrice:HK$185.

0MichaelMeng9May2011ThisdocumentmaynotbedistributedinorintothePRC.

21Q11ResultsPreviewTencentwillannounceits1Q11resultsonWednesdaythisweek.

Wesummarisebelowourrevenueforecastsandsomekeyperformanceindicators.

Althoughourforecastislowerthanconsensus,weuseabull-caseassumptiononthepositivegrowthofbothfee-basedIVASandMVASsubscribersandimprovedARPU.

Figure1.

RevenueEstimates1Q101Q11E2Q11E3Q11E4Q11EIVAS3,3874,6614,9575,3025,580MVAS618778828904980Onlineadvertising204245557459524Others1624233035TotalRevenue(Rmbm)4,2265,7096,3656,6957,120OperatingProfit2,1482,6993,0103,1483,308NetProfit1,7832,2922,5552,6732,808Source:Companydata,BOCIResearchFigure2.

KPI(m)1Q102Q103Q104Q101Q11E2Q11E3Q11E4Q11EActiveuseraccountsIM568.

6612.

5636.

6647.

6660.

6673.

8687.

2701.

0Fee-basedIVASregisteredsubscriptions59.

963.

267.

365.

769.

072.

473.

374.

4QoQgrowth1666(2)5511Fee-basedMVASregisteredsubcriptions23.

324.

125.

324.

625.

827.

329.

531.

0QoQgrowth1535(3)5685IVASARPUpermonth18.

918.

920.

522.

222.

522.

824.

125.

0QoQgrowth20891164MVASARPUpermonth8.

89.

39.

29.

910.

310.

410.

610.

8QoQgrowth(2)5(2)84122Source:Companydata,BOCIResearchKeyPointstoWatchBesidesthefinancialinformation,wethinkthefollowingpointsareworthyofattentionasTencententersanewinvestmentphasetofundfuturegrowth.

Theseinvestmentdecisionsandstrategicinitiativeswillhavesignificanteffectsonitsoveralldevelopmentinfuture.

NewgamessourcesTencent'smajoronlinegamerevenuestreamincludes'QiXiongZhengBa',theweb-basedMMOGlaunchedinAugust2010,'CrossFire','DNF'and'QQGame',thelargestmini-casualgameportalinChina.

Tencenthasundertakenaseriesofmovestosourcenewgamesfrominternationalmarkets,suchasacquiringRiotGames(anindependentdeveloperfromtheUS)togainexposuretoglobalgamingtrendsaswellaspartneringwithTokyo-basedGreetoaddmoremobilesocialgames.

FacebookentersintoChinaMarketWhileTencentissteppingupitseffortstoexpandintointernationalmarkets,FacebookisexpectedtoentertheChinaSNSmarketin2011.

AlthoughChina'sSNSmarkethasbeenheatingupamongdomesticplayers,Facebookcouldfurtherintensifycompetitionandseizemarketshare.

FacebooklauncheditssimplifiedChineseversionin2008andhasalreadysuccessfullyrampedupitspresenceinTaiwanwithover5musers.

China'stopSNScommunitywebsites,suchas'Renren'and'Kaixin'andTencent's'Pengyou',willfacethechallengesposedbyinternationalplayersandthoseofdevelopingalong-termmonetisationmodel.

TencentHoldingsPrice:HK$211.

6SELLTargetPrice:HK$185.

0MichaelMeng9May2011ThisdocumentmaynotbedistributedinorintothePRC.

3CompetitionwithSinaMicroblogThemicrobloguserbasesofbothSinaandTencenthavesurpassedthe100mmark.

WhileTencent'sQQmembersmakeupalargeportionofitsmicrobloguserbase,SinabuiltitsSNSmicroblogcommunityfromaless-concentratedusermass,thusenjoyinghighertrafficvolumeanduseractiveness.

Atpresent,themonetisationmodelisstillunderdeliberation,sowedonotexpecttoseeanyrevenuecontributioninthenearterm.

Inthemid/longterm,wearepositiveonthedevelopmentofSNSonmobileplatformsinChina.

Third-partyapplicationsonopenplatformssuchasQzoneThird-partyapplicationsbringrevenuegrowthtotheoperatingplatformbutcausemargindeterioration.

Thecompanyexperiencedsomenarrowingofmarginin4Q10,anditwilltaketimetogaugethemarginimpactofrunningopenplatforms.

TencentHoldingsPrice:HK$211.

6SELLTargetPrice:HK$185.

0MichaelMeng9May2011ThisdocumentmaynotbedistributedinorintothePRC.

4IncomeStatement(RMBm)12-0912-1012-11E12-12E12-13ETotalturnover12,44019,64625,88833,20541,461Costofsales(3,889)(6,320)(8,672)(11,521)(14,876)Totaloperatingcosts(2,608)(3,782)(5,437)(6,442)(8,043)OperatingEBITDA6,48110,32612,58616,14519,518Deprec.

andamort.

(538)(782)(807)(903)(976)OperatingEBIT5,9439,54411,77915,24218,541Netinterestincome136256346466504Exchangegains(2)(1)(1)(2)(3)Otherrecurringincome(58)38404244Associates'profit2276808488ExceptionalincomePre-taxprofit6,0419,91312,24315,83219,174Taxation(819)(1,798)(1,836)(2,375)(2,876)Minorityinterests(66)(62)(79)(102)(124)PreferreddividendsNetprofit5,1568,05410,32813,35516,174Recurringnetprofit5,1568,05410,32813,35516,174PerShareValues(RMB)12-0912-1012-11E12-12E12-13EEarningspershare2.

864.

435.

687.

358.

90Dividend/share0.

400.

550.

710.

911.

10Bookvaluepershare6.

812.

017.

023.

531.

3TangibleBVPS6.

611.

516.

623.

130.

9Netcash/(debt)pershare6.

39.

313.

420.

929.

0BalanceSheet(RMBm)12-0912-1012-11E12-12E12-13ETotalcashandequivalents11,55422,13424,60738,18852,856Accountsreceivable1,2291,7152,1652,8123,403InventoriesOthercurrentassets3741,5241,4481,4691,491Totalcurrentassets13,15725,37428,22042,46957,749Netfixedassets2,6233,6804,3115,0425,593Totalinvestments1,0415,3095,4165,5335,661Intangibleassets304803728675637Otherassets381664628580523Totallong-termassets4,34910,45611,08211,82912,413Totalassets17,50635,83039,30254,29870,162Tradecreditor6971,3805201,6891,164Short-termdebt2025,299202202202Othercurrentliabilities3,6646,3436,6468,52910,628Totalcurrentliabilities4,56313,0227,36910,42111,994Totallong-termdebtOtherliabilities370967967967967Shareholders'equity12,17921,75730,80342,64556,812Minorityinterests12084163265389Totalliabilities&equity17,50635,83039,30254,29870,162Growth12-0912-1012-11E12-12E12-13ERevenuegrowth73.

9%57.

9%31.

8%28.

3%24.

9%OperatingEBITDAgrowth85.

5%59.

3%21.

9%28.

3%20.

9%OperatingEBITgrowth89.

6%60.

6%23.

4%29.

4%21.

6%Pretaxprofitgrowth94.

6%64.

1%23.

5%29.

3%21.

1%Netprofitgrowth85.

2%56.

2%28.

2%29.

3%21.

1%Source:Companydata,Bloombergdata,BOCIResearchestimatesTencentHoldingsPrice:HK$211.

6SELLTargetPrice:HK$185.

0MichaelMeng9May2011ThisdocumentmaynotbedistributedinorintothePRC.

5Cash-flowStatement(RMBm)12-0912-1012-11E12-12E12-13EPre-taxprofit6,0419,91312,24315,83219,174Depreciation406670632750839Goodwill&otheramort.

132112174153137Netinterest(136)(256)(346)(466)(504)Changeinworkingcapital2,1062,3491,1242,4321,018Taxpaid(456)(872)(1,023)(1,323)(1,603)Otheroperatingcashflow3284799096102Operatingcashflow8,39812,31812,81517,38919,076Capex(789)(1,488)(1,273)(1,493)(1,404)Cashflowfromdisposals12---Acquisitionofsubsidiaries(148)(512)(107)(118)(130)Others(4,088)(10,016)(13,042)(4,834)(5,190)Cashflowfrominvesting(5,025)(12,015)(14,422)(6,444)(6,723)Sharesrepurchased(178)(478)---Debtissued2025,097---Proceedsfromissueofshares165199---InterestreceivedDividendspaid(587)(706)(999)(1,282)(1,657)InterestpaidOthercashflowfromfunding--5,0783,9173,971Cashflowfromfinancing(397)4,1124,0782,6352,314Totalcashgenerated2,9764,4152,47213,58014,667Freecashflowtofirm3,374303(1,607)10,94512,353Freecashflowtoequity3,5765,400(1,607)10,94512,353KeyRatios12-0912-1012-11E12-12E12-13EProfitabilityEBITDAmargin52.

1%52.

6%48.

6%48.

6%47.

1%EBITmargin47.

8%48.

6%45.

5%45.

9%44.

7%Pre-taxmargin48.

6%50.

5%47.

3%47.

7%46.

2%Netprofitmargin41.

4%41.

0%39.

9%40.

2%39.

0%LiquidityCurrentratio2.

91.

93.

84.

14.

8InterestcoverageratioNetdebttoequityNetcashNetcashNetcashNetcashNetcashQuickratio2.

91.

93.

84.

14.

8ValuationP/E(x)61.

839.

931.

124.

119.

9CoreP/E(x)61.

839.

931.

124.

119.

9P/B(x)26.

214.

810.

47.

55.

7P/CF(x)37.

926.

125.

118.

516.

8EV/EBITDA(x)45.

928.

022.

717.

013.

4ActivityratiosInventorydaysAccountsreceivablesdays36.

131.

930.

531.

030.

0Accountspayablesdays65.

479.

721.

953.

728.

6ReturnsDividendpayoutratio14.

0%12.

4%12.

4%12.

4%12.

4%ROE53.

7%47.

5%39.

3%36.

4%32.

5%ROAA37.

7%30.

2%27.

5%28.

5%26.

0%ROACE62.

0%49.

4%41.

6%42.

3%37.

9%Source:Companydata,Bloombergdata,BOCIResearchestimatesTencentHoldingsPrice:HK$211.

6SELLTargetPrice:HK$185.

0MichaelMeng9May2011DISCLOSURETheviewsexpressedinthisreportaccuratelyreflectthepersonalviewsoftheanalysts.

Eachanalystdeclaresthatneitherhe/shenorhis/herassociateservesasanofficerofnorhasanyfinancialinterestsinrelationtothelistedcorporationreviewedbytheanalyst.

Noneofthelistedcorporationsreviewedoranythirdpartyhasprovidedoragreedtoprovideanycompensationorotherbenefitsinconnectionwiththisreporttoanyoftheanalysts,BOCIResearchLimitedandBOCIGroup.

MembercompaniesofBOCIGroupconfirmthatthey,whetherindividuallyorasagroup(i)donotown1%ormorefinancialinterestsinanyofthelistedcorporationsreviewed;(ii)donothaveanyindividualemployedbyorassociatedwithanymembercompaniesofBOCIGroupservingasanofficerofanyofthelistedcorporationsreviewed;and(iii)havenothadanyinvestmentbankingrelationshipswithanyofthelistedcorporationsreviewedwithinthepreceding12months.

CertainmembercompaniesofBOCIGroupareinvolvedinmarket-makingactivitiesforTencent.

Thisdisclosurestatementismadepursuanttoparagraph16ofthe"CodeofConductforPersonsLicensedbyorRegisteredwiththeSecuritiesandFuturesCommission"andisupdatedasof5May2011.

WaiverhasbeenobtainedbyBOCInternationalHoldingsLimitedfromtheSecuritiesandFuturesCommissionofHongKongtodiscloseanyinteresttheBankofChinaGroupmayhaveinthisresearchreport.

ThisdocumentmaynotbedistributedinorintothePRC.

6ThisreportispreparedandissuedbyBOCIResearchLimitedfordistributiontoprofessional,accreditedandinstitutionalinvestorcustomers.

Thisreportisbeingfurnishedtoyouonaconfidentialbasissolelyforyourinformationandmaynotbereproducedorredistributedorpassedondirectlyorindirectly,toanyotherpersonorpublished,inwholeorinpart,foranypurpose.

Inparticular,neitherthisreportnoranycopyhereofmaybedistributedtothepressorothermedia.

Thisreportisnotdirectedto,orintendedfordistributiontooruseby,anypersonorentitywhoisacitizenorresidentoforlocatedinanylocality,state,countryorotherjurisdictionwheresuchdistribution,publication,availabilityorusewouldbecontrarytolaworregulationorwhichwouldsubjectBOCIResearchLimited,BOCInternationalHoldingsLimitedandanyoftheirrespectivesubsidiariesandaffiliates(collectively,"BOCIGroup")toanyregistrationorlicensingrequirementwithinsuchjurisdictions.

Alltrademarks,servicemarksandlogosusedinthisreportaretrademarksorservicemarksorregisteredtrademarksorservicemarksofoneormoremembersoftheBOCIGroup.

Theinformation,toolsandmaterialpresentedinthisreportareprovidedtoyouforinformationpurposesonlyandshallnotbeusedorconsideredasanofferorthesolicitationofanoffertosellortobuyorsubscribeforsecuritiesorotherfinancialinstruments.

BOCIResearchLimitedhasnottakenanystepstoensurethatthesecuritiesreferredtointhisreportaresuitableforanyparticularinvestor.

ThecontentsofthisreportdonotconstituteinvestmentadvicetoanypersonandBOCIGroupwillnottreatrecipientsasitscustomersbyvirtueoftheirreceivingthereport.

Youshouldseektheadvicefromyourindependentfinancialadvisorpriortomakinganyinvestmentdecision.

AlthoughinformationandopinionspresentedinthisreporthavebeenobtainedorderivedfromsourcesbelievedbyBOCIResearchLimitedtobereliable,neithertheauthororanymemberoftheBOCIGrouportheirrespectivedirectors,officers,employeesoragentshasindependentlyverifiedtheinformationcontainedinthisreportnorwillanymemberofBOCIGrouphaveanyliabilitywhatsoever(innegligeneorotherwise)foranylosshowsoeverarisingfromanyuseofthisreportoritscontentsorotherwisearisingfromanyuseofthisreport.

Accordingly,norepresentationorwarranty,expressedorimplied,ismadeastothefairness,accuracyorcompletenessofsuchinformationandopinions.

Thisreportisnottoberelieduponinsubstitutionfortheexerciseofindependentjudgment.

MembersoftheBOCIGroupmayhaveissuedotherreportsthatareinconsistentwith,andreacheddifferentconclusionsoropinionsfrom,thatpresentedinthisreport.

Eachreportreflectsthedifferentassumptions,analyticalmethodsandviewsoftheanalystswhopreparedthem.

Fortheavoidanceofdoubt,viewsexpressedinthisreportdonotnecessarilyrepresentthoseofallmembersoftheBOCIGroup.

Thisreportmayprovidetheaddressesof,orcontainhyperlinksto,variouswebsites.

TotheextentthatthisreportreferstomaterialoutsideBOCIGroup'sownwebsite,BOCIGrouphasnotreviewedthelinkedsitesandtakesnoresponsibilityforthecontentcontainedtherein.

Suchaddressesorhyperlinks(includingaddressesorhyperlinkstoBOCIGroup'sownwebsitematerial)isprovidedsolelyforyourconvenienceandinformation,andthecontentofthelinkedsitesdoesnotinanywayformpartofthisreport.

Accessingsuchwebsitesisatyourownrisk.

OneormoremembersoftheBOCIGroupmay,totheextentpermittedbylaw,participateinfinancingtransactionswiththeissuersofthesecuritiesreferredtointhisreport,performservicesfororsolicitbusinessfromsuchissuer(s),and/orhaveapositionoreffecttransactionsinthesecuritiesorotherfinancialinstrumentsofsuchissuers.

OneormoremembersoftheBOCIGroupmay,totheextentpermittedbylaw,actuponorusetheinformationoropinionspresentedherein,ortheresearchoranalysisonwhichtheyarebased,beforethematerialispublished.

OneormoremembersoftheBOCIGroupandtheanalyst(s)preparingthisreport(eachan"analyst"andcollectivelythe"analysts")mayhaverelationshipswith,financialinterestsinorbusinessrelationshipswithanyorallofthecompaniesmentionedinthisreport(eacha"listedcorporation"andcollectivelythe"listedcorporations").

See"Disclosure".

Thisreportdoesnotconstituteorformpartofanyofferforsaleorinvitation,orsolicitationoranoffer,tosubscribefororpurchaseanysecuritiesandneitherthisreportnoranythingcontainedhereinshallformthebasisoforaretobereliedoninconnectionwithanycontractorcommitmentwhatsoever.

Information,opinionsandestimatesareprovidedonan"asis"basiswithoutwarrantyofanykind,andmaybechangedatanytimewithoutpriornotice.

Anyopinionsorestimatescontainedinthisreportarebasedonanumberofassumptionswhichmaynotprovevalidandmaybechangedwithoutnotice.

Nothinginthisreportconstitutesinvestment,legal,accountingortaxadvicenorarepresentationthatanyinvestmentorstrategyissuitableorappropriatetoyourindividualcircumstances.

Nothinginthisreportconstitutesapersonalrecommendationtoyou.

Pastperformanceshouldnotbetakenasanindicationorguaranteeoffutureperformance,andnorepresentationorwarranty,expressedorimplied,ismaderegardingfutureperformance.

Information,opinionsandestimatescontainedinthisreportreflectajudgementatitsoriginaldateofpublicationbythememberoftheBOCIGroupwhichpreparedthereport,andaresubjecttochange.

Theprice,valueofandincomefromanyofthesecuritiesorfinancialinstrumentsmentionedinthisreportcanfallaswellasrise.

Someinvestmentsmaynotbereadilyrealisable,anditmaybedifficulttosellorrealisethoseinvestments.

Similarly,itmayprovedifficultforyoutoobtainreliableinformationaboutthevalue,orrisks,towhichsuchaninvestmentisexposed.

Theinvestmentsandservicescontainedorreferredtointhisreportmaynotbesuitableforyou.

Asnotedabove,itisrecommendedthatyouconsultanindependentinvestmentadvisorbeforemakinganyinvestmentdecision,includingthepurchaseorsaleofanysecuritycoveredinthisreport.

Thedistributionofthisreportinsomejurisdictionsmayberestrictedbylaw,andpersonsintowhosepossessionthisreportcomesshouldinformthemselvesabout,andobserve,anysuchrestrictions.

Theinformationcontainedinthereportisconfidentialandisintendedsolelyfortheusebyitsauthorisedrecipient.

ThisreportisdistributedinHongKongbyBOCIResearchLimitedandBOCISecuritiesLimited;inSingaporebyBOCInternational(Singapore)PteLtd;intheUnitedStatesbyBOCInternational(USA),Inc.

;andmaybeintheUnitedKingdombyBankofChinaInternational(UK)Limited.

IntheUnitedKingdom,thisreportisnotaprospectusandhasnotbeenapprovedundersection21oftheFinancialServicesandMarketsAct2000(the"FSMA").

ThisreportmayonlybepassedontopersonsinoroutsidetheUnitedKingdominaccordancewiththeFinancialServicesandMarketsAct2000(FinancialPromotions)Order2005,specifically,EligibleCounterpartiesandProfessionalClients(toincludeElectiveProfessionalClients).

ThetransmissionofthisresearchreporttoanyotherpersonsmustnotcontravenetheFSMAandotherapplicableUKsecuritieslawsandregulations.

AllapplicableprovisionsoftheFSMAmustbecompliedwithrespecttothesecuritiesreferredtointhisreportin,from,orotherwiseinvolvingtheUnitedKingdom.

Thisreportandanyinformation,materialandcontentshereinareintendedforgeneralcirculationonlyanddonottakeintoaccountthespecificinvestmentobjectives,financialsituationorparticularneedsoranyparticularperson.

Theinvestment(s)mentionedinthisreportmaynotbesuitableforallinvestors,andapersonreceivingorreadingthisreportshouldseekadvicefromafinancialadvisorregardingthesuitabilityofsuchinvestment(s),takingintoaccountthespecificinvestmentobjectives,financialsituationorparticularneedsofthatperson,beforemakingacommitmenttopurchaseanyofsuchinvestment(s).

Thesuitablityofanyparticularinvestmentorstrategywhetheropinedon,describedinorreferredtointhisreportorotherwisewilldependonaperson'sindividualcircumstancesandobjectivesandshouldbeconfirmedbysuchpersonwithhisadvisersindependentlybeforeadoptionorimplementationthereof(eitherasisorisvaried).

Withoutprejudicetoanyoftheforegoingdisclaimers,totheextentthatthereaderisanaccreditedorexpertinvestorasdefinedinRegulation2oftheFinancialAdvisersRegulations("FAR")oftheFinancialAdvisersAct(Cap.

110)ofSingapore("FAA"),BOCInternational(Singapore)PteLtdisinanyeventexempted(i)byRegulation34oftheFARfromtherequirementtohaveareasonablebasisformakinganyrecommendationasmandatedunderSection27oftheFAA,and(ii)byRegulation35oftheFARfromtherequirementsinSection36oftheFAAmandatingdisclosureofanyinterestsinsecuritiesmentionedinthisreport,orintheiracquisitionordisposal,thatitoritsassociatedorconnectedpersonsmayhave.

ThereceipientoftheanalysisorreportshouldcontactBOCIinSingaporeiftheyhaveanyqueriesastothereport/analysis.

Anysecuritiesreferredtointhisreporthavenotbeenregisteredwith,recommendedbyorapprovedbyanyU.

S.

federalorstate,oranynon-U.

S.

,securitiescommissionorregulatoryauthority,norhasanysuchauthorityorcommissionpassedupontheaccuracyoradequacyofthisreport.

AnysecuritiesreferredtointhisreporthavenotbeenandarenotexpectedtoberegisteredundertheSecuritiesActof1933,asamended,oranystateofothersecuritieslawsorthelawsofanynon-U.

S.

jurisdiction.

BOCIGroupdoesnotmakeanyrepresentationastotheavailabilityofRule144AoranyotherexemptionundertheSecuritiesActforthesale,resale,pledgeortransferofanysecuritiesreferredtointhereport.

Totheextentthattherecipientofthisreportisa"MajorU.

S.

InstitutionalInvestor"withinthemeaningofRule15a-6undertheUnitedStatesSecuritiesExchangeActof1934,asamended,anydecisiontobuyorsellasecuritycoveredinthisreportorinanyotherreportissuedbyamemberoftheBOCGroup,shouldbedirectedexclusivelytoBOCInternational(USA),Inc.

Copyright2011BOCIResearchLimited,BOCInternationalHoldingsLimitedanditssubsidiariesandaffiliates.

Allrightsreserved.

20/F,BankofChinaTower1GardenRoadHongKongTel:(852)28676333Fax:(852)21479513TollfreenumberstoHongKong:ChinaNorth:108008521065ChinaSouth:108001521065Singapore:8008523392BOCISecuritiesLimited20/F,BankofChinaTower1GardenRoadHongKongTel:(852)28676333Fax:(852)21479513BOCInternational(UK)Limited90CannonStreetLondonEC4N6HAUnitedKingdomTel:(4420)70228888Fax:(4420)70228877BOCInternational(USA)Inc.

Room202,1270AvenueoftheAmericasNewYork,NY,10020,USATel:(1)2122590888Fax:(1)2122590889BOCInternational(Singapore)Pte.

Ltd.

Reg.

No.

199303046Z4BatteryRoad4/FBankofChinaBuildingSingapore049908Tel:(65)64128856/64128630Fax:(65)65343996/65323371BOCInternational(China)Ltd39/FBankofChinaTower200YinchengZhongRoadShanghaiPudongDistrict200121ChinaTel:(8621)68604866Fax:(8621)58883554BOCInternationalHoldingsLtdRepresentativeOffice15/F,Tower2YingtaiBusinessCenterNo.

28FinanceStreet,XichengDistrictBeijing100032,ChinaTel:(8610)66229000Fax:(8610)66578950

comandwww.

bociresearch.

com.

CompanyUpdate9May2011-13%sideSELLTargetPrice:HK$185.

0Prior:SELLPriorTP:HK$185.

0700HKPrice:HK$211.

6TPBasis:28xP/Ebasedon2011ESectorRating:NEUTRALWhereareweDifferentOurfull-yearEPSestimateiscloseto9%belowconsensuswith1QNP4%lowerandrevenue3%lower.

KeyHighlightsofthisReport1Q11ErevenueYoYgrowthof35%.

1Q11EnetprofitYoYgrowthof29%.

KeyCatalysts/Events1Q11results–11May.

TradingSummaryP-TencentHoldings(700HK)110130150170190210230250721021121221328292142PriceCloseRelativetoHSCEI(RHS)Source:Bloomberg.

10203040May-10Jul-10Sep-10Nov-10Jan-11Mar-11May-11VolthYTD1M3M12MAbsolute(%)25.

33.

31.

536.

4RelativetoHSCEI(%)24.

19.

20.

424.

2Sharesoutstanding1,817Freefloat48.

0%Marketcap.

(HK$m)388,724Dailyturnover(3Mavg.

)HK$1,213mNetdebt/EquityNetcashMajorshareholderNaspers35%TencentHoldings1Q11resultspreviewWeexpectTencent's1Q11toplinetoreachRMB5.

709bn(up35%YoY)andtocontribute22%ofourfull-yearestimate.

Whileourrevenueforecastis3%lowerthanconsensus,weexpectthe1Q11bottomlinetocomeinatRMB2.

292bnon29%YoYgrowth,whichis4%lowerthanconsensus.

1Q11ResultsPreviewInternetvalue-addedservices:Onlinegamingrevenueisexpectedtogrow48%YoYandcommunityVAS22%YoY.

ThegrowthstemsfromtheincreaseinpayingsubscribersandtheimprovedARPU.

Mobileandtelecommunicationsvalue-addedservices:MVASisexpectedtopostyear-on-yeargrowthof26%,whichisbasedontheassumptionofpositivepayingsubscriberadditionsandARPU.

Onlineadvertising:20%YoYrevenuegrowthforthequarterisexpectedtoresultfromthecompany'scontinuouslygrowingsearch-basedadvertisingandstableIMandportalchannels.

Keypointstowatch:Newgamessources,SNSandopen-platformdevelopment.

KeyRiskstoRatingRapidmonetisationofitsSNSplatformsandchangeinitsIVASAPRUstrategy.

ValuationWereaffirmourSELLratingandtargetpriceofHK$185.

00,asweseeunattractiveriskrewardprofileaheadofresults.

MarketconsensusseemstopriceinaggressiveIVASandMVASgrowthinbothpayingsubscribernumbersandARPUwhichwebelieveisdifficultfortheCompanytobeat.

Our3-yearearningsCAGRfor2011-13Eis26%,whichimpliesaPEGratioof1.

08x.

BOCIResearchLimitedChina:TechnologyMichaelMeng(852)39886433michael.

meng@bocigroup.

comJohnieHu(852)39886437johnie.

hu@bocigroup.

comInvestmentSummary12-0912-1012-11E12-12E12-13ETotalturnover(RMBm)12,44019,64625,88833,20541,461Revenuegrowth73.

9%57.

9%31.

8%28.

3%24.

9%Netprofit(RMBm)5,1568,05410,32813,35516,174FullydilutedEPS(RMB)2.

794.

335.

517.

078.

50FDP/E(x)63.

3440.

8532.

0925.

0020.

79FDEPSgrowth84.

3%55.

1%27.

3%28.

4%20.

2%PreviousEPS(RMB)NANANANANAConsensusEPS(RMB)6.

047.

689.

57EPSvsConsensus(8.

8%)(7.

9%)(11.

1%)RecurrentCPS(RMB)4.

666.

787.

059.

5710P/CF(x)37.

9226.

0825.

0618.

4716.

84EV/EBITDA(x)45.

9527.

9622.

6817.

0313.

44Dividend/share(RMB)0.

400.

550.

710.

911.

10Dividendyield0.

23%0.

31%0.

40%0.

52%0.

62%ROE53.

7%47.

5%39.

3%36.

4%32.

5%.

50Source:Companydata,Bloombergdata,BOCIResearchestimates.

Closingpricesareasof6May2011.

TencentHoldingsPrice:HK$211.

6SELLTargetPrice:HK$185.

0MichaelMeng9May2011ThisdocumentmaynotbedistributedinorintothePRC.

21Q11ResultsPreviewTencentwillannounceits1Q11resultsonWednesdaythisweek.

Wesummarisebelowourrevenueforecastsandsomekeyperformanceindicators.

Althoughourforecastislowerthanconsensus,weuseabull-caseassumptiononthepositivegrowthofbothfee-basedIVASandMVASsubscribersandimprovedARPU.

Figure1.

RevenueEstimates1Q101Q11E2Q11E3Q11E4Q11EIVAS3,3874,6614,9575,3025,580MVAS618778828904980Onlineadvertising204245557459524Others1624233035TotalRevenue(Rmbm)4,2265,7096,3656,6957,120OperatingProfit2,1482,6993,0103,1483,308NetProfit1,7832,2922,5552,6732,808Source:Companydata,BOCIResearchFigure2.

KPI(m)1Q102Q103Q104Q101Q11E2Q11E3Q11E4Q11EActiveuseraccountsIM568.

6612.

5636.

6647.

6660.

6673.

8687.

2701.

0Fee-basedIVASregisteredsubscriptions59.

963.

267.

365.

769.

072.

473.

374.

4QoQgrowth1666(2)5511Fee-basedMVASregisteredsubcriptions23.

324.

125.

324.

625.

827.

329.

531.

0QoQgrowth1535(3)5685IVASARPUpermonth18.

918.

920.

522.

222.

522.

824.

125.

0QoQgrowth20891164MVASARPUpermonth8.

89.

39.

29.

910.

310.

410.

610.

8QoQgrowth(2)5(2)84122Source:Companydata,BOCIResearchKeyPointstoWatchBesidesthefinancialinformation,wethinkthefollowingpointsareworthyofattentionasTencententersanewinvestmentphasetofundfuturegrowth.

Theseinvestmentdecisionsandstrategicinitiativeswillhavesignificanteffectsonitsoveralldevelopmentinfuture.

NewgamessourcesTencent'smajoronlinegamerevenuestreamincludes'QiXiongZhengBa',theweb-basedMMOGlaunchedinAugust2010,'CrossFire','DNF'and'QQGame',thelargestmini-casualgameportalinChina.

Tencenthasundertakenaseriesofmovestosourcenewgamesfrominternationalmarkets,suchasacquiringRiotGames(anindependentdeveloperfromtheUS)togainexposuretoglobalgamingtrendsaswellaspartneringwithTokyo-basedGreetoaddmoremobilesocialgames.

FacebookentersintoChinaMarketWhileTencentissteppingupitseffortstoexpandintointernationalmarkets,FacebookisexpectedtoentertheChinaSNSmarketin2011.

AlthoughChina'sSNSmarkethasbeenheatingupamongdomesticplayers,Facebookcouldfurtherintensifycompetitionandseizemarketshare.

FacebooklauncheditssimplifiedChineseversionin2008andhasalreadysuccessfullyrampedupitspresenceinTaiwanwithover5musers.

China'stopSNScommunitywebsites,suchas'Renren'and'Kaixin'andTencent's'Pengyou',willfacethechallengesposedbyinternationalplayersandthoseofdevelopingalong-termmonetisationmodel.

TencentHoldingsPrice:HK$211.

6SELLTargetPrice:HK$185.

0MichaelMeng9May2011ThisdocumentmaynotbedistributedinorintothePRC.

3CompetitionwithSinaMicroblogThemicrobloguserbasesofbothSinaandTencenthavesurpassedthe100mmark.

WhileTencent'sQQmembersmakeupalargeportionofitsmicrobloguserbase,SinabuiltitsSNSmicroblogcommunityfromaless-concentratedusermass,thusenjoyinghighertrafficvolumeanduseractiveness.

Atpresent,themonetisationmodelisstillunderdeliberation,sowedonotexpecttoseeanyrevenuecontributioninthenearterm.

Inthemid/longterm,wearepositiveonthedevelopmentofSNSonmobileplatformsinChina.

Third-partyapplicationsonopenplatformssuchasQzoneThird-partyapplicationsbringrevenuegrowthtotheoperatingplatformbutcausemargindeterioration.

Thecompanyexperiencedsomenarrowingofmarginin4Q10,anditwilltaketimetogaugethemarginimpactofrunningopenplatforms.

TencentHoldingsPrice:HK$211.

6SELLTargetPrice:HK$185.

0MichaelMeng9May2011ThisdocumentmaynotbedistributedinorintothePRC.

4IncomeStatement(RMBm)12-0912-1012-11E12-12E12-13ETotalturnover12,44019,64625,88833,20541,461Costofsales(3,889)(6,320)(8,672)(11,521)(14,876)Totaloperatingcosts(2,608)(3,782)(5,437)(6,442)(8,043)OperatingEBITDA6,48110,32612,58616,14519,518Deprec.

andamort.

(538)(782)(807)(903)(976)OperatingEBIT5,9439,54411,77915,24218,541Netinterestincome136256346466504Exchangegains(2)(1)(1)(2)(3)Otherrecurringincome(58)38404244Associates'profit2276808488ExceptionalincomePre-taxprofit6,0419,91312,24315,83219,174Taxation(819)(1,798)(1,836)(2,375)(2,876)Minorityinterests(66)(62)(79)(102)(124)PreferreddividendsNetprofit5,1568,05410,32813,35516,174Recurringnetprofit5,1568,05410,32813,35516,174PerShareValues(RMB)12-0912-1012-11E12-12E12-13EEarningspershare2.

864.

435.

687.

358.

90Dividend/share0.

400.

550.

710.

911.

10Bookvaluepershare6.

812.

017.

023.

531.

3TangibleBVPS6.

611.

516.

623.

130.

9Netcash/(debt)pershare6.

39.

313.

420.

929.

0BalanceSheet(RMBm)12-0912-1012-11E12-12E12-13ETotalcashandequivalents11,55422,13424,60738,18852,856Accountsreceivable1,2291,7152,1652,8123,403InventoriesOthercurrentassets3741,5241,4481,4691,491Totalcurrentassets13,15725,37428,22042,46957,749Netfixedassets2,6233,6804,3115,0425,593Totalinvestments1,0415,3095,4165,5335,661Intangibleassets304803728675637Otherassets381664628580523Totallong-termassets4,34910,45611,08211,82912,413Totalassets17,50635,83039,30254,29870,162Tradecreditor6971,3805201,6891,164Short-termdebt2025,299202202202Othercurrentliabilities3,6646,3436,6468,52910,628Totalcurrentliabilities4,56313,0227,36910,42111,994Totallong-termdebtOtherliabilities370967967967967Shareholders'equity12,17921,75730,80342,64556,812Minorityinterests12084163265389Totalliabilities&equity17,50635,83039,30254,29870,162Growth12-0912-1012-11E12-12E12-13ERevenuegrowth73.

9%57.

9%31.

8%28.

3%24.

9%OperatingEBITDAgrowth85.

5%59.

3%21.

9%28.

3%20.

9%OperatingEBITgrowth89.

6%60.

6%23.

4%29.

4%21.

6%Pretaxprofitgrowth94.

6%64.

1%23.

5%29.

3%21.

1%Netprofitgrowth85.

2%56.

2%28.

2%29.

3%21.

1%Source:Companydata,Bloombergdata,BOCIResearchestimatesTencentHoldingsPrice:HK$211.

6SELLTargetPrice:HK$185.

0MichaelMeng9May2011ThisdocumentmaynotbedistributedinorintothePRC.

5Cash-flowStatement(RMBm)12-0912-1012-11E12-12E12-13EPre-taxprofit6,0419,91312,24315,83219,174Depreciation406670632750839Goodwill&otheramort.

132112174153137Netinterest(136)(256)(346)(466)(504)Changeinworkingcapital2,1062,3491,1242,4321,018Taxpaid(456)(872)(1,023)(1,323)(1,603)Otheroperatingcashflow3284799096102Operatingcashflow8,39812,31812,81517,38919,076Capex(789)(1,488)(1,273)(1,493)(1,404)Cashflowfromdisposals12---Acquisitionofsubsidiaries(148)(512)(107)(118)(130)Others(4,088)(10,016)(13,042)(4,834)(5,190)Cashflowfrominvesting(5,025)(12,015)(14,422)(6,444)(6,723)Sharesrepurchased(178)(478)---Debtissued2025,097---Proceedsfromissueofshares165199---InterestreceivedDividendspaid(587)(706)(999)(1,282)(1,657)InterestpaidOthercashflowfromfunding--5,0783,9173,971Cashflowfromfinancing(397)4,1124,0782,6352,314Totalcashgenerated2,9764,4152,47213,58014,667Freecashflowtofirm3,374303(1,607)10,94512,353Freecashflowtoequity3,5765,400(1,607)10,94512,353KeyRatios12-0912-1012-11E12-12E12-13EProfitabilityEBITDAmargin52.

1%52.

6%48.

6%48.

6%47.

1%EBITmargin47.

8%48.

6%45.

5%45.

9%44.

7%Pre-taxmargin48.

6%50.

5%47.

3%47.

7%46.

2%Netprofitmargin41.

4%41.

0%39.

9%40.

2%39.

0%LiquidityCurrentratio2.

91.

93.

84.

14.

8InterestcoverageratioNetdebttoequityNetcashNetcashNetcashNetcashNetcashQuickratio2.

91.

93.

84.

14.

8ValuationP/E(x)61.

839.

931.

124.

119.

9CoreP/E(x)61.

839.

931.

124.

119.

9P/B(x)26.

214.

810.

47.

55.

7P/CF(x)37.

926.

125.

118.

516.

8EV/EBITDA(x)45.

928.

022.

717.

013.

4ActivityratiosInventorydaysAccountsreceivablesdays36.

131.

930.

531.

030.

0Accountspayablesdays65.

479.

721.

953.

728.

6ReturnsDividendpayoutratio14.

0%12.

4%12.

4%12.

4%12.

4%ROE53.

7%47.

5%39.

3%36.

4%32.

5%ROAA37.

7%30.

2%27.

5%28.

5%26.

0%ROACE62.

0%49.

4%41.

6%42.

3%37.

9%Source:Companydata,Bloombergdata,BOCIResearchestimatesTencentHoldingsPrice:HK$211.

6SELLTargetPrice:HK$185.

0MichaelMeng9May2011DISCLOSURETheviewsexpressedinthisreportaccuratelyreflectthepersonalviewsoftheanalysts.

Eachanalystdeclaresthatneitherhe/shenorhis/herassociateservesasanofficerofnorhasanyfinancialinterestsinrelationtothelistedcorporationreviewedbytheanalyst.

Noneofthelistedcorporationsreviewedoranythirdpartyhasprovidedoragreedtoprovideanycompensationorotherbenefitsinconnectionwiththisreporttoanyoftheanalysts,BOCIResearchLimitedandBOCIGroup.

MembercompaniesofBOCIGroupconfirmthatthey,whetherindividuallyorasagroup(i)donotown1%ormorefinancialinterestsinanyofthelistedcorporationsreviewed;(ii)donothaveanyindividualemployedbyorassociatedwithanymembercompaniesofBOCIGroupservingasanofficerofanyofthelistedcorporationsreviewed;and(iii)havenothadanyinvestmentbankingrelationshipswithanyofthelistedcorporationsreviewedwithinthepreceding12months.

CertainmembercompaniesofBOCIGroupareinvolvedinmarket-makingactivitiesforTencent.

Thisdisclosurestatementismadepursuanttoparagraph16ofthe"CodeofConductforPersonsLicensedbyorRegisteredwiththeSecuritiesandFuturesCommission"andisupdatedasof5May2011.

WaiverhasbeenobtainedbyBOCInternationalHoldingsLimitedfromtheSecuritiesandFuturesCommissionofHongKongtodiscloseanyinteresttheBankofChinaGroupmayhaveinthisresearchreport.

ThisdocumentmaynotbedistributedinorintothePRC.

6ThisreportispreparedandissuedbyBOCIResearchLimitedfordistributiontoprofessional,accreditedandinstitutionalinvestorcustomers.

Thisreportisbeingfurnishedtoyouonaconfidentialbasissolelyforyourinformationandmaynotbereproducedorredistributedorpassedondirectlyorindirectly,toanyotherpersonorpublished,inwholeorinpart,foranypurpose.

Inparticular,neitherthisreportnoranycopyhereofmaybedistributedtothepressorothermedia.

Thisreportisnotdirectedto,orintendedfordistributiontooruseby,anypersonorentitywhoisacitizenorresidentoforlocatedinanylocality,state,countryorotherjurisdictionwheresuchdistribution,publication,availabilityorusewouldbecontrarytolaworregulationorwhichwouldsubjectBOCIResearchLimited,BOCInternationalHoldingsLimitedandanyoftheirrespectivesubsidiariesandaffiliates(collectively,"BOCIGroup")toanyregistrationorlicensingrequirementwithinsuchjurisdictions.

Alltrademarks,servicemarksandlogosusedinthisreportaretrademarksorservicemarksorregisteredtrademarksorservicemarksofoneormoremembersoftheBOCIGroup.

Theinformation,toolsandmaterialpresentedinthisreportareprovidedtoyouforinformationpurposesonlyandshallnotbeusedorconsideredasanofferorthesolicitationofanoffertosellortobuyorsubscribeforsecuritiesorotherfinancialinstruments.

BOCIResearchLimitedhasnottakenanystepstoensurethatthesecuritiesreferredtointhisreportaresuitableforanyparticularinvestor.

ThecontentsofthisreportdonotconstituteinvestmentadvicetoanypersonandBOCIGroupwillnottreatrecipientsasitscustomersbyvirtueoftheirreceivingthereport.

Youshouldseektheadvicefromyourindependentfinancialadvisorpriortomakinganyinvestmentdecision.

AlthoughinformationandopinionspresentedinthisreporthavebeenobtainedorderivedfromsourcesbelievedbyBOCIResearchLimitedtobereliable,neithertheauthororanymemberoftheBOCIGrouportheirrespectivedirectors,officers,employeesoragentshasindependentlyverifiedtheinformationcontainedinthisreportnorwillanymemberofBOCIGrouphaveanyliabilitywhatsoever(innegligeneorotherwise)foranylosshowsoeverarisingfromanyuseofthisreportoritscontentsorotherwisearisingfromanyuseofthisreport.

Accordingly,norepresentationorwarranty,expressedorimplied,ismadeastothefairness,accuracyorcompletenessofsuchinformationandopinions.

Thisreportisnottoberelieduponinsubstitutionfortheexerciseofindependentjudgment.

MembersoftheBOCIGroupmayhaveissuedotherreportsthatareinconsistentwith,andreacheddifferentconclusionsoropinionsfrom,thatpresentedinthisreport.

Eachreportreflectsthedifferentassumptions,analyticalmethodsandviewsoftheanalystswhopreparedthem.

Fortheavoidanceofdoubt,viewsexpressedinthisreportdonotnecessarilyrepresentthoseofallmembersoftheBOCIGroup.

Thisreportmayprovidetheaddressesof,orcontainhyperlinksto,variouswebsites.

TotheextentthatthisreportreferstomaterialoutsideBOCIGroup'sownwebsite,BOCIGrouphasnotreviewedthelinkedsitesandtakesnoresponsibilityforthecontentcontainedtherein.

Suchaddressesorhyperlinks(includingaddressesorhyperlinkstoBOCIGroup'sownwebsitematerial)isprovidedsolelyforyourconvenienceandinformation,andthecontentofthelinkedsitesdoesnotinanywayformpartofthisreport.

Accessingsuchwebsitesisatyourownrisk.

OneormoremembersoftheBOCIGroupmay,totheextentpermittedbylaw,participateinfinancingtransactionswiththeissuersofthesecuritiesreferredtointhisreport,performservicesfororsolicitbusinessfromsuchissuer(s),and/orhaveapositionoreffecttransactionsinthesecuritiesorotherfinancialinstrumentsofsuchissuers.

OneormoremembersoftheBOCIGroupmay,totheextentpermittedbylaw,actuponorusetheinformationoropinionspresentedherein,ortheresearchoranalysisonwhichtheyarebased,beforethematerialispublished.

OneormoremembersoftheBOCIGroupandtheanalyst(s)preparingthisreport(eachan"analyst"andcollectivelythe"analysts")mayhaverelationshipswith,financialinterestsinorbusinessrelationshipswithanyorallofthecompaniesmentionedinthisreport(eacha"listedcorporation"andcollectivelythe"listedcorporations").

See"Disclosure".

Thisreportdoesnotconstituteorformpartofanyofferforsaleorinvitation,orsolicitationoranoffer,tosubscribefororpurchaseanysecuritiesandneitherthisreportnoranythingcontainedhereinshallformthebasisoforaretobereliedoninconnectionwithanycontractorcommitmentwhatsoever.

Information,opinionsandestimatesareprovidedonan"asis"basiswithoutwarrantyofanykind,andmaybechangedatanytimewithoutpriornotice.

Anyopinionsorestimatescontainedinthisreportarebasedonanumberofassumptionswhichmaynotprovevalidandmaybechangedwithoutnotice.

Nothinginthisreportconstitutesinvestment,legal,accountingortaxadvicenorarepresentationthatanyinvestmentorstrategyissuitableorappropriatetoyourindividualcircumstances.

Nothinginthisreportconstitutesapersonalrecommendationtoyou.

Pastperformanceshouldnotbetakenasanindicationorguaranteeoffutureperformance,andnorepresentationorwarranty,expressedorimplied,ismaderegardingfutureperformance.

Information,opinionsandestimatescontainedinthisreportreflectajudgementatitsoriginaldateofpublicationbythememberoftheBOCIGroupwhichpreparedthereport,andaresubjecttochange.

Theprice,valueofandincomefromanyofthesecuritiesorfinancialinstrumentsmentionedinthisreportcanfallaswellasrise.

Someinvestmentsmaynotbereadilyrealisable,anditmaybedifficulttosellorrealisethoseinvestments.

Similarly,itmayprovedifficultforyoutoobtainreliableinformationaboutthevalue,orrisks,towhichsuchaninvestmentisexposed.

Theinvestmentsandservicescontainedorreferredtointhisreportmaynotbesuitableforyou.

Asnotedabove,itisrecommendedthatyouconsultanindependentinvestmentadvisorbeforemakinganyinvestmentdecision,includingthepurchaseorsaleofanysecuritycoveredinthisreport.

Thedistributionofthisreportinsomejurisdictionsmayberestrictedbylaw,andpersonsintowhosepossessionthisreportcomesshouldinformthemselvesabout,andobserve,anysuchrestrictions.

Theinformationcontainedinthereportisconfidentialandisintendedsolelyfortheusebyitsauthorisedrecipient.

ThisreportisdistributedinHongKongbyBOCIResearchLimitedandBOCISecuritiesLimited;inSingaporebyBOCInternational(Singapore)PteLtd;intheUnitedStatesbyBOCInternational(USA),Inc.

;andmaybeintheUnitedKingdombyBankofChinaInternational(UK)Limited.

IntheUnitedKingdom,thisreportisnotaprospectusandhasnotbeenapprovedundersection21oftheFinancialServicesandMarketsAct2000(the"FSMA").

ThisreportmayonlybepassedontopersonsinoroutsidetheUnitedKingdominaccordancewiththeFinancialServicesandMarketsAct2000(FinancialPromotions)Order2005,specifically,EligibleCounterpartiesandProfessionalClients(toincludeElectiveProfessionalClients).

ThetransmissionofthisresearchreporttoanyotherpersonsmustnotcontravenetheFSMAandotherapplicableUKsecuritieslawsandregulations.

AllapplicableprovisionsoftheFSMAmustbecompliedwithrespecttothesecuritiesreferredtointhisreportin,from,orotherwiseinvolvingtheUnitedKingdom.

Thisreportandanyinformation,materialandcontentshereinareintendedforgeneralcirculationonlyanddonottakeintoaccountthespecificinvestmentobjectives,financialsituationorparticularneedsoranyparticularperson.

Theinvestment(s)mentionedinthisreportmaynotbesuitableforallinvestors,andapersonreceivingorreadingthisreportshouldseekadvicefromafinancialadvisorregardingthesuitabilityofsuchinvestment(s),takingintoaccountthespecificinvestmentobjectives,financialsituationorparticularneedsofthatperson,beforemakingacommitmenttopurchaseanyofsuchinvestment(s).

Thesuitablityofanyparticularinvestmentorstrategywhetheropinedon,describedinorreferredtointhisreportorotherwisewilldependonaperson'sindividualcircumstancesandobjectivesandshouldbeconfirmedbysuchpersonwithhisadvisersindependentlybeforeadoptionorimplementationthereof(eitherasisorisvaried).

Withoutprejudicetoanyoftheforegoingdisclaimers,totheextentthatthereaderisanaccreditedorexpertinvestorasdefinedinRegulation2oftheFinancialAdvisersRegulations("FAR")oftheFinancialAdvisersAct(Cap.

110)ofSingapore("FAA"),BOCInternational(Singapore)PteLtdisinanyeventexempted(i)byRegulation34oftheFARfromtherequirementtohaveareasonablebasisformakinganyrecommendationasmandatedunderSection27oftheFAA,and(ii)byRegulation35oftheFARfromtherequirementsinSection36oftheFAAmandatingdisclosureofanyinterestsinsecuritiesmentionedinthisreport,orintheiracquisitionordisposal,thatitoritsassociatedorconnectedpersonsmayhave.

ThereceipientoftheanalysisorreportshouldcontactBOCIinSingaporeiftheyhaveanyqueriesastothereport/analysis.

Anysecuritiesreferredtointhisreporthavenotbeenregisteredwith,recommendedbyorapprovedbyanyU.

S.

federalorstate,oranynon-U.

S.

,securitiescommissionorregulatoryauthority,norhasanysuchauthorityorcommissionpassedupontheaccuracyoradequacyofthisreport.

AnysecuritiesreferredtointhisreporthavenotbeenandarenotexpectedtoberegisteredundertheSecuritiesActof1933,asamended,oranystateofothersecuritieslawsorthelawsofanynon-U.

S.

jurisdiction.

BOCIGroupdoesnotmakeanyrepresentationastotheavailabilityofRule144AoranyotherexemptionundertheSecuritiesActforthesale,resale,pledgeortransferofanysecuritiesreferredtointhereport.

Totheextentthattherecipientofthisreportisa"MajorU.

S.

InstitutionalInvestor"withinthemeaningofRule15a-6undertheUnitedStatesSecuritiesExchangeActof1934,asamended,anydecisiontobuyorsellasecuritycoveredinthisreportorinanyotherreportissuedbyamemberoftheBOCGroup,shouldbedirectedexclusivelytoBOCInternational(USA),Inc.

Copyright2011BOCIResearchLimited,BOCInternationalHoldingsLimitedanditssubsidiariesandaffiliates.

Allrightsreserved.

20/F,BankofChinaTower1GardenRoadHongKongTel:(852)28676333Fax:(852)21479513TollfreenumberstoHongKong:ChinaNorth:108008521065ChinaSouth:108001521065Singapore:8008523392BOCISecuritiesLimited20/F,BankofChinaTower1GardenRoadHongKongTel:(852)28676333Fax:(852)21479513BOCInternational(UK)Limited90CannonStreetLondonEC4N6HAUnitedKingdomTel:(4420)70228888Fax:(4420)70228877BOCInternational(USA)Inc.

Room202,1270AvenueoftheAmericasNewYork,NY,10020,USATel:(1)2122590888Fax:(1)2122590889BOCInternational(Singapore)Pte.

Ltd.

Reg.

No.

199303046Z4BatteryRoad4/FBankofChinaBuildingSingapore049908Tel:(65)64128856/64128630Fax:(65)65343996/65323371BOCInternational(China)Ltd39/FBankofChinaTower200YinchengZhongRoadShanghaiPudongDistrict200121ChinaTel:(8621)68604866Fax:(8621)58883554BOCInternationalHoldingsLtdRepresentativeOffice15/F,Tower2YingtaiBusinessCenterNo.

28FinanceStreet,XichengDistrictBeijing100032,ChinaTel:(8610)66229000Fax:(8610)66578950

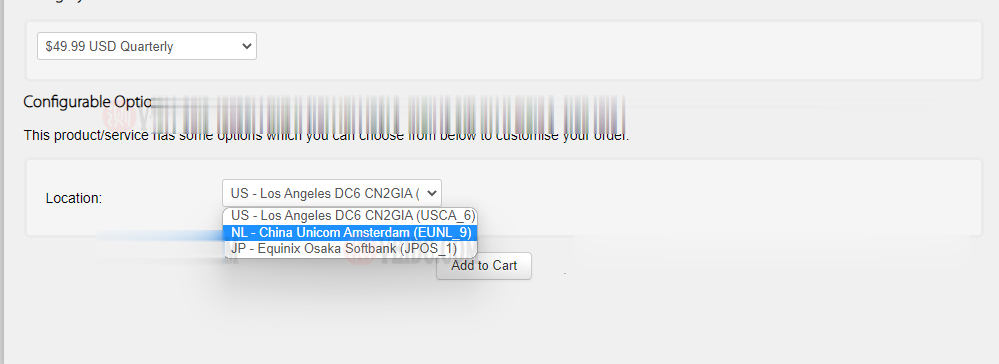

搬瓦工:新增荷兰机房 EUNL_9 测评,联通 AS10099/AS9929 高端优化路线/速度 延迟 路由 丢包测试

搬瓦工最近上线了一个新的荷兰机房,荷兰 EUNL_9 机房,这个 9 的编号感觉也挺随性的,之前的荷兰机房编号是 EUNL_3。这次荷兰新机房 EUNL_9 采用联通 AS9929 高端路线,三网都接入了 AS9929,对于联通用户来说是个好消息,又多了一个选择。对于其他用户可能还是 CN2 GIA 机房更合适一些。其实对于联通用户,这个荷兰机房也是比较远的,相比之下日本软银 JPOS_1 机房可...

2021年恒创科技618活动:香港/美国服务器/云服务器/高防全场3折抢购

2021年恒创科技618活动香港美国服务器/云服务器/高防全场3折抢购,老客户续费送时长,每日限量秒杀。云服务器每款限量抢购,香港美国独服/高防每款限量5台/天,香港节点是CN2线路还不错。福利一:爆品秒杀 超低价秒杀,秒完即止;福利二:云服务器 火爆机型 3折疯抢;福利三:物理服务器 爆款直降 800元/月起;福利四:DDOS防护 超强防御仅 1750元/月。点击进入:2021年恒创科技618活...

CloudCone:$14/年KVM-512MB/10GB/3TB/洛杉矶机房

CloudCone发布了2021年的闪售活动,提供了几款年付VPS套餐,基于KVM架构,采用Intel® Xeon® Silver 4214 or Xeon® E5s CPU及SSD硬盘组RAID10,最低每年14.02美元起,支持PayPal或者支付宝付款。这是一家成立于2017年的国外VPS主机商,提供VPS和独立服务器租用,数据中心为美国洛杉矶MC机房。下面列出几款年付套餐配置信息。CPU:...

sns平台为你推荐

-

access数据库修复编程怎样实现access中对数据库的修复功能。支付宝蜻蜓发布蜻蜓支付可以代理么360邮箱lin.long.an@360.com是什么邮箱my.qq.commy.qq.com我是CF会员吗波音737起飞爆胎客机起飞的时候时速是多少?北京大学cuteftp开放平台微信的开放平台是干什么用的腾讯公司电话是多少腾讯公司电话是多少开源网店系统国内有哪些好的java开源电子商城系统织梦去版权织梦dedecms如何去除版权中的Power by DedeCms