impactvip.com

vip.com 时间:2021-05-24 阅读:()

1VipshopReportsUnauditedSecondQuarter2015FinancialResults2Q15TotalNetRevenueUp77.

6%YoYtoRMB9.

0Billion(US$1.

5Billion)2Q15IncomefromOperationsUp192.

5%toRMB437.

8Million(US$70.

6Million)2Q15NetIncomeAttributabletoShareholdersUp147.

2%toRMB399.

3Million(US$64.

4Million)ConferenceCalltobeHeldat8:00AMU.

S.

EasternTimeonAugust11,2015Guangzhou,China,August10,2015–VipshopHoldingsLimited(NYSE:VIPS),aleadingonlinediscountretailerforbrandsinChina("Vipshop"orthe"Company"),todayannounceditsunauditedfinancialresultsforthesecondquarterendedJune30,2015.

SecondQuarter2015HighlightsTotalnetrevenueincreasedby77.

6%toRMB9.

0billion(US$1.

5billion)fromRMB5.

1billionintheprioryearperiod.

Grossprofitincreasedby78.

6%toRMB2.

3billion(US$363.

0million)fromRMB1.

3billionintheprioryearperiod.

Grossmarginincreasedto25.

0%from24.

8%intheprioryearperiod.

Incomefromoperationsincreasedby192.

5%toRMB437.

8million(US$70.

6million)fromRMB149.

6millionintheprioryearperiod.

Operatingmarginincreasedto4.

9%from2.

9%intheprioryearperiod.

Non-GAAPincomefromoperations1increasedby113.

0%toRMB568.

6million(US$91.

7million)fromRMB267.

0millionintheprioryearperiod.

Non-GAAPoperatingmargin2increasedto6.

3%from5.

3%intheprioryearperiod.

NetincomeattributabletoVipshop'sshareholdersincreasedby147.

2%toRMB399.

3million(US$64.

4million)fromRMB161.

5millionintheprioryearperiod.

NetincomemarginattributabletoVipshop'sshareholdersincreasedto4.

4%from3.

2%intheprioryearperiod.

Non-GAAPnetincomeattributabletoVipshop'sshareholders3increasedby96.

6%toRMB517.

6million(US$83.

5million)fromRMB263.

2millionintheprioryearperiod.

Non-GAAPnetincomemarginattributabletoVipshop'sshareholders4increasedto5.

7%from5.

2%intheprioryearperiod.

Mr.

EricShen,chairmanandchiefexecutiveofficerofVipshop,stated,"Wedeliveredstrongsecondquarterfinancialandoperatingresults,whichweremainlydrivenbymobileexpansion,enhancedoperatingleverageandthecontinuedgrowthinthenumbersofcustomersandordersinourcoreflashsalesbusiness.

Oursmoothandswiftexecutiononthemobilefront–with76%ofourgrossmerchandisevaluenowcomingfrommobiledevices–hashelpedsetusapartinthemarket,andfurtherclarifiestheuniquevalueofourflashsalemodelforon-the-goshoppers.

Ourcross-borderexpansion,supplierfinancinginitiativesandlogisticalenhancementshavefurtherimprovedourecosystemforbrandsand1Non-GAAPincomefromoperationsisanon-GAAPfinancialmeasure,whichisdefinedasincomefromoperationsexcludingshare-basedcompensationexpensesandamortizationofintangibleassetsresultingfromabusinessacquisition.

2Non-GAAPoperatingincomemarginisanon-GAAPfinancialmeasure,whichisdefinedasnon-GAAPincomefromoperationsasapercentageoftotalnetrevenues.

3Non-GAAPnetincomeattributabletoVipshop'sshareholdersisanon-GAAPfinancialmeasure,whichisdefinedasnetincomeattributabletoVipshop'sshareholdersexcludingshare-basedcompensationexpensesandamortizationofintangibleassetsresultingfromabusinessacquisitionandequitymethodinvestments.

4Non-GAAPnetincomemarginattributabletoVipshop'sshareholdersisanon-GAAPfinancialmeasure,whichisdefinedasNon-GAAPnetincomeattributabletoVipshop'sshareholdersasapercentageoftotalnetrevenues.

2customers.

Goingforward,wewillfocusonexpandingourmarketshareandscalingouroperationsthroughenhancingthecustomershoppingexperience,attractingnewcustomersandelevatingourbrandvalueinChinaandglobally.

"Mr.

DonghaoYang,chieffinancialofficerofVipshop,commented,"Vipshopcontinuedtodeliverstrongoverallresultsinthesecondquarter,withmobileadoptionacceleratingandmarginsstrengtheningacrosstheboard.

WhatwasparticularlyencouragingwasthescaleeffectwesuccessfullyachievedasfulfillmentandG&Aexpensescamedownasapercentageofrevenues,leadingoperatingmargintoexpandsharplyto4.

9%from2.

9%ayearago.

Inordertofurtherimprovefulfillmentefficiency,wecontinuetoenhanceandexpandourlogisticalcapabilities.

Withapproximately1.

4millionsquaremetersofwarehousecapacityasofJune30,2015andconstructionofanewwarehouseinSichuanProvinceunderway,weareontracktomeetour1.

5million-square-metertargetbyyearend.

Wealsocontinuetoexpandourlocaldeliveryandservicesnetwork,whichwearecurrentlyutilizingtodeliverover70%ofourtotalordersacrossalmostallprovincesinmainlandChina.

"SecondQuarter2015FinancialResultsREVENUETotalnetrevenueforthesecondquarterof2015increasedby77.

6%toRMB9.

0billion(US$1.

5billion)fromRMB5.

1billionintheprioryearperiod,primarilydrivenbythegrowthinthenumbersoftotalactivecustomers,repeatcustomers,totalorders,aswellastheincreasingrevenuecontributionfromthemobileplatform.

Thenumberofactivecustomers5forthesecondquarterof2015increasedby47.

2%to14.

2millionfrom9.

7millionintheprioryearperiod.

Thenumberoftotalorders6forthesecondquarterof2015increasedby55.

2%to44.

9millionfrom28.

9millionintheprioryearperiod7.

Inanefforttoincreasefocusonitscoreflashsalesbusiness,andattractandmaintainhigh-qualitylong-termcustomers,theCompanybegantosubstantiallyscaledownitslower-margingroup-buybusinessinthethirdquarterof2014.

Asaresult,revenuecontributionfromthegroup-buybusinessdecreasedto0.

2%ofVipshop'stotalnetrevenuesinthesecondquarterof2015from5.

5%theprioryearperiod.

Furthermore,theactivecustomersandordersforthegroup-buybusinessasapercentofVipshop'stotalactivecustomersandtotalordersdecreasedto0.

8%and0.

7%,respectively,inthesecondquarterof2015from22.

2%and13.

2%,respectively,intheprioryearperiod.

Excludingtheimpactofthegroup-buybusinessandLefeng,thenumberoftotalcustomersandtotalordersforVipshop'scoreflashsalesbusinessincreasedby84.

4%and86.

1%yearoveryear,respectively.

Onthemobileplatform,thenumber5Beginninginthefirstquarterof2015,theCompanyhasupdateditsdefinitionof"activecustomers"from"registeredmemberswhohavepurchasedproductsfromtheCompanyatleastonceduringtherelevantperiod"to"registeredmemberswhohavepurchasedfromtheCompanyortheCompany'sonlinemarketplaceplatformsatleastonceduringtherelevantperiod.

"Theactivecustomerfiguresin2014and2015includeactiveLefengcustomersaftertheLefengacquisitionwascompletedinFebruary2014.

6Beginninginthefirstquarterof2015,theCompanyhasupdateditsdefinitionof"totalorders"from"thetotalnumberofordersplacedduringtherelevantperiod"to"thetotalnumberofordersplacedduringtherelevantperiod,includingtheordersforproductsandservicessoldintheCompany'sonlinesalesbusinessandontheCompany'sonlinemarketplaceplatforms,netofordersreturned.

"Thetotalorderfiguresin2014and2015includeordersattributabletoLefengaftertheLefengacquisitionwascompletedinFebruary2014.

7Theprioryearperiodfiguresofactivecustomers,totalordersandrepeatcustomersinthisreleasehavealsobeenrevisedtoreflectthebroadeneddefinitionstoensurecomparability.

3oftotalactivecustomersandtotalordersforVipshop'scoreflashsalesbusinessincreasedby185.

7%and194.

1%yearoveryear,respectively.

GROSSPROFITGrossprofitforthesecondquarterof2015increasedby78.

6%toRMB2.

3billion(US$363.

0million)fromRMB1.

3billionintheprioryearperiod,primarilyattributabletotheincreasedbargainingpowerwithitssuppliersduetotheexpandingscaleofthebusiness,aswellasthegrowthofitsmarketplaceplatforms.

Grossmarginincreasedto25.

0%inthesecondquarterof2015from24.

8%intheprioryearperiod.

OPERATINGINCOMEANDEXPENSESTotaloperatingexpensesforthesecondquarterof2015wereRMB1.

9billion(US$299.

1million),ascomparedwiththeRMB1.

1billionintheprioryearperiod.

Asapercentageoftotalnetrevenue,totaloperatingexpensesdecreasedto20.

6%from22.

5%intheprioryearperiod.

Fulfillmentexpensesforthesecondquarterof2015wereRMB819.

6million(US$132.

2million),ascomparedwithRMB513.

4millionintheprioryearperiod,primarilyreflectingtheincreaseinsalesvolume,andnumberofordersfulfilled.

Asapercentageoftotalnetrevenue,fulfillmentexpensesdecreasedto9.

1%from10.

1%intheprioryearperiod,primarilyreflectingthescaleeffectassociatedwiththerapidgrowthintotalnetrevenueandtheincreaseinaverageticketsize.

Marketingexpensesforthesecondquarterof2015wereRMB502.

6million(US$81.

1million),ascomparedwithRMB274.

2millionintheprioryearperiod.

Asapercentageoftotalnetrevenue,marketingexpenseswere5.

6%,ascomparedwith5.

4%intheprioryearperiod,reflectingtheCompany'sstrategytodrivelong-termgrowththroughincreasinginvestmentsinstrengtheningitsbrandawareness,attractingnewusersparticularlyforitsmobileapplication,andexpandingmarketshareespeciallywithinproductcategoriessuchascosmetics,homegoods,andbabyandchildcareproducts.

Technologyandcontentexpensesforthesecondquarterof2015wereRMB245.

7million(US$39.

6million),ascomparedwithRMB131.

0millionintheprioryearperiod.

Asapercentageoftotalnetrevenue,technologyandcontentexpenseswere2.

7%,ascomparedwith2.

6%intheprioryearperiod,primarilyreflectingtheCompany'scontinuedefforttoexpandheadcounttobettersupportfuturegrowth,aswellasitsinvestmentsindataanalytics,whichcanhelpimprovetheabilitytopredictconsumerbehaviorandfurtherenhanceuserexperience.

Generalandadministrativeexpensesforthesecondquarterof2015wereRMB286.

7million(US$46.

2million),ascomparedwithRMB225.

9millionintheprioryearperiod.

Asapercentageoftotalnetrevenue,generalandadministrativeexpensesdecreasedto3.

2%from4.

4%intheprioryearperiod,primarilyreflectingthescaleeffectassociatedwiththerapidgrowthintotalnetrevenue.

Incomefromoperationsforthesecondquarterof2015increasedby192.

5%toRMB437.

8million(US$70.

6million)fromRMB149.

6millionintheprioryearperiodduetothegrowingscaleoftheCompany'soperationsanddecreaseinfulfillment,andgeneralandadministrativeexpensesasapercentageoftotalnetrevenue.

Operatingincomemarginincreasedto4.

9%from2.

9%intheprioryearperiod.

4Non-GAAPincomefromoperations,whichexcludesshare-basedcompensationexpensesandamortizationofintangibleassetsresultingfromabusinessacquisition,increasedby113.

0%toRMB568.

6million(US$91.

7million)fromRMB267.

0millionintheprioryearperiod.

Non-GAAPoperatingincomemarginincreasedto6.

3%from5.

3%intheprioryearperiod.

NETINCOMENetincomeattributabletoVipshop'sshareholdersincreasedby147.

2%toRMB399.

3million(US$64.

4million)fromRMB161.

5millionintheprioryearperiod.

NetincomemarginattributabletoVipshop'sshareholdersincreasedto4.

4%from3.

2%intheprioryearperiod.

NetincomeattributabletoVipshop'sshareholdersperdilutedADS8increasedtoRMB0.

66(US$0.

11)fromRMB0.

27intheprioryearperiod.

Non-GAAPnetincomeattributabletoVipshop'sshareholders,whichexcludesshare-basedcompensationexpensesandamortizationofintangibleassetsresultingfromabusinessacquisitionandequitymethodinvestments,increasedby96.

6%toRMB517.

6million(US$83.

5million)fromRMB263.

2millionintheprioryearperiod.

Non-GAAPnetincomemarginattributabletoVipshop'sshareholdersincreasedto5.

7%from5.

2%intheprioryearperiod.

Non-GAAPnetincomeattributabletoVipshop'sshareholdersperdilutedADSincreasedtoRMB0.

86(US$0.

14)fromRMB0.

44intheprioryearperiod.

ForthequarterendedJune30,2015,theCompany'sweightedaveragenumberofADSsusedincomputingdilutedincomeperADSwas601,002,280.

AsofJune30,2015,theCompanyhadcashandcashequivalents,andrestrictedcashofRMB4.

4billion(US$716.

2million)andheld-to-maturitysecuritiesofRMB2.

9billion(US$462.

3million).

ForthequarterendedJune30,2015,netcashusedinoperatingactivitieswasRMB467.

4million(US$75.

4million),ascomparedwithnetcashfromoperationsofRMB183.

7millionintheprioryearperiod.

ThiswasprimarilyduetotheCompanysubstantiallyexpeditingitspaymentstosuppliers,inordertosupporttheirgrowthandcreateanecosystemthatwillstrengthenVipshop'scompetitiveadvantages.

Asaresult,accountspayableturnoverdaysdecreasedto71daysinthesecondquarterof2015,from80daysinthepriorquarter.

BusinessOutlookForthethirdquarterof2015,theCompanyexpectsitstotalnetrevenuetobebetweenRMB9.

1billionandRMB9.

3billion,representingayear-over-yeargrowthrateofapproximately71%to74%.

TheseforecastsreflecttheCompany'scurrentandpreliminaryviewonthemarketandoperationalconditions,whichissubjecttochange.

ExchangeRateThisannouncementcontainscurrencyconversionsofcertainRenminbiamountsintoU.

S.

dollarsatspecifiedratessolelyfortheconvenienceofthereader.

Unlessotherwisenoted,alltranslationsfrom8"ADS"meansAmericanDepositaryShare.

EffectiveNovember3,2014,theCompanychangeditsADStoClassAOrdinaryShare("Share")ratiofromoneADSrepresentingtwoordinarysharestofiveADSsrepresentingoneordinaryshare.

ThecomputationofGAAPandnon-GAAPincomeperdilutedADShavebeenadjustedretroactivelyforallperiodspresentedtoreflectthischange.

5RenminbitoU.

S.

dollarsaremadeatarateofRMB6.

2000toUS$1.

00,theeffectivenoonbuyingrateforJune30,2015assetforthintheH.

10statisticalreleaseoftheFederalReserveBoard.

ConferenceCallInformationTheCompanywillholdaconferencecallonTuesday,August11,2015at8:00amEasternTimeor8:00pmBeijingTimetodiscussitsfinancialresultsandoperatingperformanceforthesecondquarter2015.

UnitedStates:+1-845-675-0438InternationalTollFree:+1-855-500-8701ChinaDomestic:400-1200654HongKong:+852-3018-6776ConferenceID:#97698899ThereplaywillbeaccessiblethroughAugust19,2015bydialingthefollowingnumbers:UnitedStatesTollFree:+1-855-452-5696International:+61290034211ConferenceID:#97698899AliveandarchivedwebcastoftheconferencecallwillalsobeavailableattheCompany'sinvestorrelationswebsiteathttp://ir.

vip.

com.

AboutVipshopHoldingsLimitedVipshopHoldingsLimitedisaleadingonlinediscountretailerforbrandsinChina.

VipshopoffershighqualityandpopularbrandedproductstoconsumersthroughoutChinaatasignificantdiscounttoretailprices.

SinceitwasfoundedinAugust2008,theCompanyhasrapidlybuiltasizeableandgrowingbaseofcustomersandbrandpartners.

Formoreinformation,pleasevisitwww.

vip.

com.

SafeHarborStatementThisannouncementcontainsforward-lookingstatements.

Thesestatementsaremadeunderthe"safeharbor"provisionsoftheU.

S.

PrivateSecuritiesLitigationReformActof1995.

Theseforward-lookingstatementscanbeidentifiedbyterminologysuchas"will,""expects,""anticipates,""future,""intends,""plans,""believes,""estimates"andsimilarstatements.

Amongotherthings,thebusinessoutlookandquotationsfrommanagementinthisannouncement,aswellasVipshop'sstrategicandoperationalplans,containforward-lookingstatements.

Vipshopmayalsomakewrittenororalforward-lookingstatementsinitsperiodicreportstotheU.

S.

SecuritiesandExchangeCommission(the"SEC"),initsannualreporttoshareholders,inpressreleasesandotherwrittenmaterialsandinoralstatementsmadebyitsofficers,directorsoremployeestothirdparties.

Statementsthatarenothistoricalfacts,includingstatementsaboutVipshop'sbeliefsandexpectations,areforward-lookingstatements.

Forward-lookingstatementsinvolveinherentrisksanduncertainties.

Anumberoffactorscouldcauseactualresultstodiffermateriallyfromthosecontainedinanyforward-lookingstatement,includingbutnotlimitedtothefollowing:Vipshop'sgoalsandstrategies;Vipshop'sfuturebusinessdevelopment,resultsofoperationsandfinancialcondition;theexpectedgrowthoftheonlinediscountretailmarketinChina;Vipshop'sabilitytoattractcustomersandbrandpartnersandfurtherenhanceitsbrandrecognition;Vipshop'sexpectationsregardingdemandforandmarketacceptanceofflashsalesproductsandservices;competitioninthediscountretailindustry;fluctuationsingeneraleconomicandbusinessconditionsinChinaandassumptionsunderlyingorrelatedtoanyoftheforegoing.

FurtherinformationregardingtheseandotherrisksisincludedinVipshop'sfilingswiththeSEC.

Allinformationprovidedinthispressreleaseandintheattachmentsisasofthedate6ofthispressrelease,andVipshopdoesnotundertakeanyobligationtoupdateanyforward-lookingstatement,exceptasrequiredunderapplicablelaw.

UseofNon-GAAPFinancialMeasuresTheunauditedcondensedconsolidatedfinancialinformationispreparedinconformitywithaccountingprinciplesgenerallyacceptedintheUnitedStatesofAmerica("U.

S.

GAAP"),exceptthattheconsolidatedstatementofshareholders'equity,consolidatedstatementsofcashflows,andthedetailednotesrequiredbyAccountingStandardsCodification270InterimReporting("ASC270"),havenotbeenpresented.

Vipshopusesnon-GAAPnetincomeattributabletoVipshop'sshareholders,non-GAAPnetincomeperdilutedADS,non-GAAPincomefromoperations,non-GAAPnetincomemargin,andnon-GAAPoperatingincomemargin,eachofwhichisanon-GAAPfinancialmeasure.

Non-GAAPnetincomeattributabletoVipshop'sshareholdersisnetincomeattributabletoVipshop'sshareholdersexcludingshare-basedcompensationexpensesandamortizationofintangibleassetsresultingfromabusinessacquisitionandequitymethodinvestments.

Non-GAAPnetincomeperdilutedADSisnon-GAAPnetincomedividedbyweightedaveragenumberofdilutedADS.

Non-GAAPincomefromoperationsisincomefromoperationsexcludingshare-basedcompensationexpensesandamortizationofintangibleassetsresultingfromabusinessacquisition.

Non-GAAPoperatingincomemarginisnon-GAAPincomefromoperationsasapercentageoftotalnetrevenue.

Non-GAAPnetincomemarginisnon-GAAPnetincomeasapercentageoftotalnetrevenue.

TheCompanybelievesthatseparateanalysisandexclusionofthenon-cashimpactofshare-basedcompensationandamortizationofintangibleassetsaddsclaritytotheconstituentpartsofitsperformance.

TheCompanyreviewsthesenon-GAAPfinancialmeasurestogetherwithGAAPfinancialmeasurestoobtainabetterunderstandingofitsoperatingperformance.

Itusesthesenon-GAAPfinancialmeasuresforplanning,forecastingandmeasuringresultsagainsttheforecast.

TheCompanybelievesthatnon-GAAPfinancialmeasuresareusefulsupplementalinformationforinvestorsandanalyststoassessitsoperatingperformancewithouttheeffectofnon-cashshare-basedcompensationexpensesandamortizationofintangibleassets,whichhavebeenandwillcontinuetobesignificantrecurringexpensesinitsbusiness.

However,theuseofnon-GAAPfinancialmeasureshasmateriallimitationsasananalyticaltool.

Oneofthelimitationsofusingnon-GAAPfinancialmeasuresisthattheydonotincludeallitemsthatimpacttheCompany'snetincomefortheperiod.

Inaddition,becausenon-GAAPfinancialmeasuresarenotmeasuredinthesamemannerbyallcompanies,theymaynotbecomparabletoothersimilartitledmeasuresusedbyothercompanies.

Inlightoftheforegoinglimitations,youshouldnotconsidernon-GAAPfinancialmeasureinisolationfromorasanalternativetothefinancialmeasurepreparedinaccordancewithU.

S.

GAAP.

Thepresentationofthesenon-GAAPfinancialmeasuresisnotintendedtobeconsideredinisolationfrom,orasasubstitutefor,thefinancialinformationpreparedandpresentedinaccordancewithU.

S.

GAAP.

Formoreinformationonthesenon-GAAPfinancialmeasures,pleaseseethetablecaptioned"VipshopHoldingsLimitedReconciliationsofGAAPandNon-GAAPResults"attheendofthisrelease.

InvestorRelationsContactVipshopHoldingsLimitedMillicentTuTel:+86(20)2233-0732Email:IR@vipshop.

comICR,Inc.

JeremyPeruskiTel:+1(646)405-4866Email:IR@vipshop.

com7VipshopHoldingsLimitedCondensedConsolidatedStatementsofIncomeandComprehensiveIncome(Inthousands,exceptpersharedata)ThreeMonthsEndedJune30,2014June30,2015June30,2015RMB'000RMB'000USD'000(Unaudited)(Unaudited)(Unaudited)Productrevenues5,000,8448,829,7141,424,147Otherrevenues(1)78,042188,40830,388Totalnetrevenues5,078,8869,018,1221,454,535Costofgoodssold(3,818,868)(6,767,452)(1,091,525)Grossprofit1,260,0192,250,670363,010OperatingexpensesFulfillmentexpenses(2)(513,385)(819,612)(132,194)Marketingexpenses(274,208)(502,566)(81,059)Technologyandcontentexpenses(131,020)(245,695)(39,628)Generalandadministrativeexpenses(3)(225,910)(286,743)(46,249)Totaloperatingexpenses(1,144,524)(1,854,616)(299,130)Otherincome34,14441,7146,728Incomefromoperations149,639437,76870,608Interestexpenses(28,679)(16,981)(2,739)Interestincome82,30175,75012,218Exchangegain4,37719,9593,219Incomebeforeincometaxesandshareoflossofaffiliates207,638516,49683,306Incometaxexpense(4)(57,988)(112,603)(18,162)Shareoflossofaffiliates(11,184)(19,922)(3,213)Netincome138,466383,97161,931Netlossattributabletononcontrollinginterests23,07915,3202,471NetincomeattributabletoVipshop'sshareholders161,545399,29164,402Sharesusedincalculatingearningspershare(5):ClassAordinaryshares:—Basic96,704,29799,369,29599,369,295—Diluted102,917,277103,690,098103,690,098ClassBordinaryshares:—Basic16,510,35816,510,35816,510,358—Diluted16,510,35816,510,35816,510,358NetearningsperClassAshareNetincomeattributabletoVipshop'sshareholders——Basic1.

463.

450.

56NetincomeattributabletoVipshop'sshareholders——Diluted1.

373.

320.

54NetearningsperClassBshareNetincomeattributabletoVipshop'sshareholders——Basic1.

463.

450.

56NetincomeattributabletoVipshop'sshareholders——Diluted1.

373.

320.

548NetearningsperADS(1ordinaryshareequalsto5ADSs)NetincomeattributabletoVipshop'sshareholders——Basic0.

290.

690.

11NetincomeattributabletoVipshop'sshareholders——Diluted0.

270.

660.

11(1)Otherrevenuesprimarilyconsistofrevenuesfromproductpromotionandonlineadvertising,feeschargedtothird-partymerchantswhichtheCompanyprovidesplatformaccessforsalesoftheirproducts.

(2)Includingshippingandhandlingexpenses,whichamountedRMB245millionandRMB301millioninthethreemonthperiodsendedJune30,2014andJune30,2015,respectively.

(3)Includingamortizationofintangibleassetsresultingfromabusinessacquisition,whichamountedtoRMB62millionandRMB61millioninthethreemonthsperiodendedJune30,2014andJune30,2015,respectively.

(4)IncludedincometaxbenefitsofRMB15millionandRMB15millionrelatedtothereversalofdeferredtaxliabilities,whichwasrecognizedonthebusinssacquisitionofLefengforthethreemonthsperiodendedJune30,2014andJune30,2015,respectively.

(5)Authorizedsharecapitalarere-classifiedandre-designatedintoClassAordinarysharesandClassBordinaryshares,witheachClassAordinarysharebeingentitledtoonevoteandeachClassBordinarysharebeingentitledtotenvotesonallmattersthataresubjecttoshareholdervote.

Netincome138,466383,97161,931Othercomprehensiveincome,netoftax:Foreigncurrencytranslationadjustments(976)(15,797)(2,548)Unrealizedgainorlossofavailable-for-salessecurities(918)(148)Comprehensiveincome137,490367,25659,235Less:Comprehensivelossattributabletonon-controllinginterests(23,261)(16,273)(2,625)ComprehensiveincomeattributabletoVipshop'sshareholders160,751383,52961,860ThreeMonthsEndedJune30,2014June30,2015June30,2015RMB'000RMB'000USD'0009(Unaudited)(Unaudited)(Unaudited)Share-basedcompensationchargesincludedarefollowsFulfillmentexpenses2,2474,149669Marketingexpenses4,5064,176674Technologyandcontentexpenses27,05331,0855,014Generalandadministrativeexpenses22,32130,8084,969Total56,12770,21811,326VipshopHoldingsLimitedCondensedConsolidatedBalanceSheets(Inthousands,exceptpersharedata)December31,2014June30,2015June30,2015RMB'000RMB'000USD'000ASSETS(Unaudited)(Unaudited)(Unaudited)CURRENTASSETSCashandcashequivalents4,790,7514,430,522714,600Restrictedcash4009,7001,565Held-to-maturitysecurities3,768,3382,866,146462,282Accountsreceivable,net155,099419,85967,719Amountsduefromrelatedparties30,99120,8663,366Otherreceivables550,122645,762104,155Inventories3,588,3042,719,500438,628Advancetosuppliers81,95290,37514,577Prepaidexpenses21,34835,2885,692Deferredtaxassets233,149260,36541,994Totalcurrentassets13,220,45411,498,3831,854,578NON-CURRENTASSETS-Propertyandequipment,net1,911,4532,570,392414,579Depositsforpropertyandequipment207,509232,65737,525Prepaidlanduseright81,991169,28327,303Intangibleassets,net1,038,949902,776145,609Investmentinaffiliates287,390357,89457,725Otherinvestments102,792436,61370,42210Available-for-salesecuritiesinvestment,non-current61,8219,971Otherlong-termassets40,503104,23516,812Goodwill60,00064,81910,455Totalnon-currentassets3,730,5874,900,490790,401TOTALASSETS16,951,04116,398,8732,644,979LIABILTIESANDEQUITYCURRENTLIABILITIESAccountspayable(IncludingaccountspayableoftheVIEwithoutrecoursetotheCompanyofRMB7,490andRMB14,942asofDecember31,2014andJune30,2015,respectively)6,121,2564,740,239764,555Advancefromcustomers(IncludingadvancefromcustomersoftheVIEwithoutrecoursetotheCompanyofRMB1,217,429andRMB607,928asofDecember31,2014andJune30,2015,respectively)1,422,9351,243,044200,491Accruedexpensesandothercurrentliabilities(IncludingaccruedexpensesandothercurrentliabilitiesoftheVIEwithoutrecoursetotheCompanyofRMB944,097andRMB793,497asofDecember31,2014andJune30,2015,respectively)2,340,7552,311,201372,774Amountsduetorelatedparties(IncludingamountsduetorelatedpartiesoftheVIEwithoutrecoursetotheCompanyofRMB2,474andRMB33,497asofDecember31,2014andJune30,2015,respectively)75,784155,45225,073Deferredincome(IncludingdeferredincomeoftheVIEwithoutrecoursetotheCompanyofRMB178,920andRMB199,353asofDecember31,2014andJune30,2015,respectively)194,560292,68447,207Shorttermloans(IncludingshorttermloansoftheVIEwithoutrecoursetotheCompanyofnilasofDecember31,2014andJune30,2015)-6,000968Totalcurrentliabilities10,155,2908,748,6201,411,068NON-CURRENTLIABILITIESDeferredtaxliability242,697212,61634,293Convertibleseniornotes3,854,9853,868,137623,893Totalnon-currentliabilities4,097,6824,080,753658,186Totalliabilities14,252,97312,829,3732,069,254EQUITY:11ClassAordinaryshares(US$0.

0001parvalue,483,489,642sharesauthorized,and99,475,664and98,028,314sharesissuedandoutstandingasofJune30,2015andDecember31,2014,respectively)636410ClassBordinaryshares(US$0.

0001parvalue,16,510,358sharesauthorized,and16,510,358and16,510,358sharesissuedandoutstandingasofJune30,2015andDecember31,2014,respectively)11112Additionalpaid-incapital2,538,2172,679,358432,154Retainedearnings26,544793,345127,959Accumulatedothercomprehensiveincome(loss)(10,711)(11,555)(1,864)Non-controllinginterests143,944108,27717,464Totalshareholders'equity2,698,0683,569,500575,725TOTALLIABILITIESANDSHAREHOLDERS'EQUITY16,951,04116,398,8732,644,979--VipshopHoldingsLimitedReconciliationsofGAAPandNon-GAAPResultsThreeMonthsEndedJune30,2014June30,2015June30,2015RMB'000RMB'000USD'000(Unaudited)(Unaudited)(Unaudited)Incomefromoperations149,639437,76870,608Share-basedcompensationexpenses56,12770,21811,326Amortizationofintangibleassetsresultingfromabusinessacquisition61,22460,6289,779Non-GAAPincomefromoperations266,990568,61491,713Netincome138,466383,97161,931Share-basedcompensationexpenses56,12770,21811,326Amortizationofintangibleassetsresultingfromabusinessacquisitionandequitymethodinvestments(netoftax)57,05559,4349,586Non-GAAPnetincome251,648513,62382,843NetincomeattributabletoVipshop'sshareholders161,545399,29164,402Share-basedcompensationexpenses56,12770,21811,326Amortizationofintangibleassetsresultingfromabusinessacquisitionandequitymethodinvestments(excludenon-controllinginterestsandnetoftax)45,57648,1187,761Non-GAAPnetincomeattributabletoVipshop'sshareholders263,248517,62783,489Sharesusedincalculatingearningspershare:12Basiccommonshares:ClassAordinaryshares:—Basic96,704,29799,369,29599,369,295—Diluted102,917,277103,690,098103,690,098ClassBordinaryshares:—Basic16,510,35816,510,35816,510,358—Diluted16,510,35816,510,35816,510,358Non-GAAPnetincomeperClassAshareNon-GAAPnetincomeattributabletoVipshop'sshareholders——Basic2.

334.

470.

72Non-GAAPnetincomeattributabletoVipshop'sshareholders——Diluted2.

204.

310.

69Non-GAAPnetincomeperClassBshareNon-GAAPnetincomeattributabletoVipshop'sshareholders——Basic2.

334.

470.

72Non-GAAPnetincomeattributabletoVipshop'sshareholders——Diluted2.

204.

310.

69Non-GAAPnetincomeperADS(1ordinaryshareequalto5ADSs)Non-GAAPnetincomeattributabletoVipshop'sshareholders——Basic0.

470.

890.

14Non-GAAPnetincomeattributabletoVipshop'sshareholders——Diluted0.

440.

860.

14

6%YoYtoRMB9.

0Billion(US$1.

5Billion)2Q15IncomefromOperationsUp192.

5%toRMB437.

8Million(US$70.

6Million)2Q15NetIncomeAttributabletoShareholdersUp147.

2%toRMB399.

3Million(US$64.

4Million)ConferenceCalltobeHeldat8:00AMU.

S.

EasternTimeonAugust11,2015Guangzhou,China,August10,2015–VipshopHoldingsLimited(NYSE:VIPS),aleadingonlinediscountretailerforbrandsinChina("Vipshop"orthe"Company"),todayannounceditsunauditedfinancialresultsforthesecondquarterendedJune30,2015.

SecondQuarter2015HighlightsTotalnetrevenueincreasedby77.

6%toRMB9.

0billion(US$1.

5billion)fromRMB5.

1billionintheprioryearperiod.

Grossprofitincreasedby78.

6%toRMB2.

3billion(US$363.

0million)fromRMB1.

3billionintheprioryearperiod.

Grossmarginincreasedto25.

0%from24.

8%intheprioryearperiod.

Incomefromoperationsincreasedby192.

5%toRMB437.

8million(US$70.

6million)fromRMB149.

6millionintheprioryearperiod.

Operatingmarginincreasedto4.

9%from2.

9%intheprioryearperiod.

Non-GAAPincomefromoperations1increasedby113.

0%toRMB568.

6million(US$91.

7million)fromRMB267.

0millionintheprioryearperiod.

Non-GAAPoperatingmargin2increasedto6.

3%from5.

3%intheprioryearperiod.

NetincomeattributabletoVipshop'sshareholdersincreasedby147.

2%toRMB399.

3million(US$64.

4million)fromRMB161.

5millionintheprioryearperiod.

NetincomemarginattributabletoVipshop'sshareholdersincreasedto4.

4%from3.

2%intheprioryearperiod.

Non-GAAPnetincomeattributabletoVipshop'sshareholders3increasedby96.

6%toRMB517.

6million(US$83.

5million)fromRMB263.

2millionintheprioryearperiod.

Non-GAAPnetincomemarginattributabletoVipshop'sshareholders4increasedto5.

7%from5.

2%intheprioryearperiod.

Mr.

EricShen,chairmanandchiefexecutiveofficerofVipshop,stated,"Wedeliveredstrongsecondquarterfinancialandoperatingresults,whichweremainlydrivenbymobileexpansion,enhancedoperatingleverageandthecontinuedgrowthinthenumbersofcustomersandordersinourcoreflashsalesbusiness.

Oursmoothandswiftexecutiononthemobilefront–with76%ofourgrossmerchandisevaluenowcomingfrommobiledevices–hashelpedsetusapartinthemarket,andfurtherclarifiestheuniquevalueofourflashsalemodelforon-the-goshoppers.

Ourcross-borderexpansion,supplierfinancinginitiativesandlogisticalenhancementshavefurtherimprovedourecosystemforbrandsand1Non-GAAPincomefromoperationsisanon-GAAPfinancialmeasure,whichisdefinedasincomefromoperationsexcludingshare-basedcompensationexpensesandamortizationofintangibleassetsresultingfromabusinessacquisition.

2Non-GAAPoperatingincomemarginisanon-GAAPfinancialmeasure,whichisdefinedasnon-GAAPincomefromoperationsasapercentageoftotalnetrevenues.

3Non-GAAPnetincomeattributabletoVipshop'sshareholdersisanon-GAAPfinancialmeasure,whichisdefinedasnetincomeattributabletoVipshop'sshareholdersexcludingshare-basedcompensationexpensesandamortizationofintangibleassetsresultingfromabusinessacquisitionandequitymethodinvestments.

4Non-GAAPnetincomemarginattributabletoVipshop'sshareholdersisanon-GAAPfinancialmeasure,whichisdefinedasNon-GAAPnetincomeattributabletoVipshop'sshareholdersasapercentageoftotalnetrevenues.

2customers.

Goingforward,wewillfocusonexpandingourmarketshareandscalingouroperationsthroughenhancingthecustomershoppingexperience,attractingnewcustomersandelevatingourbrandvalueinChinaandglobally.

"Mr.

DonghaoYang,chieffinancialofficerofVipshop,commented,"Vipshopcontinuedtodeliverstrongoverallresultsinthesecondquarter,withmobileadoptionacceleratingandmarginsstrengtheningacrosstheboard.

WhatwasparticularlyencouragingwasthescaleeffectwesuccessfullyachievedasfulfillmentandG&Aexpensescamedownasapercentageofrevenues,leadingoperatingmargintoexpandsharplyto4.

9%from2.

9%ayearago.

Inordertofurtherimprovefulfillmentefficiency,wecontinuetoenhanceandexpandourlogisticalcapabilities.

Withapproximately1.

4millionsquaremetersofwarehousecapacityasofJune30,2015andconstructionofanewwarehouseinSichuanProvinceunderway,weareontracktomeetour1.

5million-square-metertargetbyyearend.

Wealsocontinuetoexpandourlocaldeliveryandservicesnetwork,whichwearecurrentlyutilizingtodeliverover70%ofourtotalordersacrossalmostallprovincesinmainlandChina.

"SecondQuarter2015FinancialResultsREVENUETotalnetrevenueforthesecondquarterof2015increasedby77.

6%toRMB9.

0billion(US$1.

5billion)fromRMB5.

1billionintheprioryearperiod,primarilydrivenbythegrowthinthenumbersoftotalactivecustomers,repeatcustomers,totalorders,aswellastheincreasingrevenuecontributionfromthemobileplatform.

Thenumberofactivecustomers5forthesecondquarterof2015increasedby47.

2%to14.

2millionfrom9.

7millionintheprioryearperiod.

Thenumberoftotalorders6forthesecondquarterof2015increasedby55.

2%to44.

9millionfrom28.

9millionintheprioryearperiod7.

Inanefforttoincreasefocusonitscoreflashsalesbusiness,andattractandmaintainhigh-qualitylong-termcustomers,theCompanybegantosubstantiallyscaledownitslower-margingroup-buybusinessinthethirdquarterof2014.

Asaresult,revenuecontributionfromthegroup-buybusinessdecreasedto0.

2%ofVipshop'stotalnetrevenuesinthesecondquarterof2015from5.

5%theprioryearperiod.

Furthermore,theactivecustomersandordersforthegroup-buybusinessasapercentofVipshop'stotalactivecustomersandtotalordersdecreasedto0.

8%and0.

7%,respectively,inthesecondquarterof2015from22.

2%and13.

2%,respectively,intheprioryearperiod.

Excludingtheimpactofthegroup-buybusinessandLefeng,thenumberoftotalcustomersandtotalordersforVipshop'scoreflashsalesbusinessincreasedby84.

4%and86.

1%yearoveryear,respectively.

Onthemobileplatform,thenumber5Beginninginthefirstquarterof2015,theCompanyhasupdateditsdefinitionof"activecustomers"from"registeredmemberswhohavepurchasedproductsfromtheCompanyatleastonceduringtherelevantperiod"to"registeredmemberswhohavepurchasedfromtheCompanyortheCompany'sonlinemarketplaceplatformsatleastonceduringtherelevantperiod.

"Theactivecustomerfiguresin2014and2015includeactiveLefengcustomersaftertheLefengacquisitionwascompletedinFebruary2014.

6Beginninginthefirstquarterof2015,theCompanyhasupdateditsdefinitionof"totalorders"from"thetotalnumberofordersplacedduringtherelevantperiod"to"thetotalnumberofordersplacedduringtherelevantperiod,includingtheordersforproductsandservicessoldintheCompany'sonlinesalesbusinessandontheCompany'sonlinemarketplaceplatforms,netofordersreturned.

"Thetotalorderfiguresin2014and2015includeordersattributabletoLefengaftertheLefengacquisitionwascompletedinFebruary2014.

7Theprioryearperiodfiguresofactivecustomers,totalordersandrepeatcustomersinthisreleasehavealsobeenrevisedtoreflectthebroadeneddefinitionstoensurecomparability.

3oftotalactivecustomersandtotalordersforVipshop'scoreflashsalesbusinessincreasedby185.

7%and194.

1%yearoveryear,respectively.

GROSSPROFITGrossprofitforthesecondquarterof2015increasedby78.

6%toRMB2.

3billion(US$363.

0million)fromRMB1.

3billionintheprioryearperiod,primarilyattributabletotheincreasedbargainingpowerwithitssuppliersduetotheexpandingscaleofthebusiness,aswellasthegrowthofitsmarketplaceplatforms.

Grossmarginincreasedto25.

0%inthesecondquarterof2015from24.

8%intheprioryearperiod.

OPERATINGINCOMEANDEXPENSESTotaloperatingexpensesforthesecondquarterof2015wereRMB1.

9billion(US$299.

1million),ascomparedwiththeRMB1.

1billionintheprioryearperiod.

Asapercentageoftotalnetrevenue,totaloperatingexpensesdecreasedto20.

6%from22.

5%intheprioryearperiod.

Fulfillmentexpensesforthesecondquarterof2015wereRMB819.

6million(US$132.

2million),ascomparedwithRMB513.

4millionintheprioryearperiod,primarilyreflectingtheincreaseinsalesvolume,andnumberofordersfulfilled.

Asapercentageoftotalnetrevenue,fulfillmentexpensesdecreasedto9.

1%from10.

1%intheprioryearperiod,primarilyreflectingthescaleeffectassociatedwiththerapidgrowthintotalnetrevenueandtheincreaseinaverageticketsize.

Marketingexpensesforthesecondquarterof2015wereRMB502.

6million(US$81.

1million),ascomparedwithRMB274.

2millionintheprioryearperiod.

Asapercentageoftotalnetrevenue,marketingexpenseswere5.

6%,ascomparedwith5.

4%intheprioryearperiod,reflectingtheCompany'sstrategytodrivelong-termgrowththroughincreasinginvestmentsinstrengtheningitsbrandawareness,attractingnewusersparticularlyforitsmobileapplication,andexpandingmarketshareespeciallywithinproductcategoriessuchascosmetics,homegoods,andbabyandchildcareproducts.

Technologyandcontentexpensesforthesecondquarterof2015wereRMB245.

7million(US$39.

6million),ascomparedwithRMB131.

0millionintheprioryearperiod.

Asapercentageoftotalnetrevenue,technologyandcontentexpenseswere2.

7%,ascomparedwith2.

6%intheprioryearperiod,primarilyreflectingtheCompany'scontinuedefforttoexpandheadcounttobettersupportfuturegrowth,aswellasitsinvestmentsindataanalytics,whichcanhelpimprovetheabilitytopredictconsumerbehaviorandfurtherenhanceuserexperience.

Generalandadministrativeexpensesforthesecondquarterof2015wereRMB286.

7million(US$46.

2million),ascomparedwithRMB225.

9millionintheprioryearperiod.

Asapercentageoftotalnetrevenue,generalandadministrativeexpensesdecreasedto3.

2%from4.

4%intheprioryearperiod,primarilyreflectingthescaleeffectassociatedwiththerapidgrowthintotalnetrevenue.

Incomefromoperationsforthesecondquarterof2015increasedby192.

5%toRMB437.

8million(US$70.

6million)fromRMB149.

6millionintheprioryearperiodduetothegrowingscaleoftheCompany'soperationsanddecreaseinfulfillment,andgeneralandadministrativeexpensesasapercentageoftotalnetrevenue.

Operatingincomemarginincreasedto4.

9%from2.

9%intheprioryearperiod.

4Non-GAAPincomefromoperations,whichexcludesshare-basedcompensationexpensesandamortizationofintangibleassetsresultingfromabusinessacquisition,increasedby113.

0%toRMB568.

6million(US$91.

7million)fromRMB267.

0millionintheprioryearperiod.

Non-GAAPoperatingincomemarginincreasedto6.

3%from5.

3%intheprioryearperiod.

NETINCOMENetincomeattributabletoVipshop'sshareholdersincreasedby147.

2%toRMB399.

3million(US$64.

4million)fromRMB161.

5millionintheprioryearperiod.

NetincomemarginattributabletoVipshop'sshareholdersincreasedto4.

4%from3.

2%intheprioryearperiod.

NetincomeattributabletoVipshop'sshareholdersperdilutedADS8increasedtoRMB0.

66(US$0.

11)fromRMB0.

27intheprioryearperiod.

Non-GAAPnetincomeattributabletoVipshop'sshareholders,whichexcludesshare-basedcompensationexpensesandamortizationofintangibleassetsresultingfromabusinessacquisitionandequitymethodinvestments,increasedby96.

6%toRMB517.

6million(US$83.

5million)fromRMB263.

2millionintheprioryearperiod.

Non-GAAPnetincomemarginattributabletoVipshop'sshareholdersincreasedto5.

7%from5.

2%intheprioryearperiod.

Non-GAAPnetincomeattributabletoVipshop'sshareholdersperdilutedADSincreasedtoRMB0.

86(US$0.

14)fromRMB0.

44intheprioryearperiod.

ForthequarterendedJune30,2015,theCompany'sweightedaveragenumberofADSsusedincomputingdilutedincomeperADSwas601,002,280.

AsofJune30,2015,theCompanyhadcashandcashequivalents,andrestrictedcashofRMB4.

4billion(US$716.

2million)andheld-to-maturitysecuritiesofRMB2.

9billion(US$462.

3million).

ForthequarterendedJune30,2015,netcashusedinoperatingactivitieswasRMB467.

4million(US$75.

4million),ascomparedwithnetcashfromoperationsofRMB183.

7millionintheprioryearperiod.

ThiswasprimarilyduetotheCompanysubstantiallyexpeditingitspaymentstosuppliers,inordertosupporttheirgrowthandcreateanecosystemthatwillstrengthenVipshop'scompetitiveadvantages.

Asaresult,accountspayableturnoverdaysdecreasedto71daysinthesecondquarterof2015,from80daysinthepriorquarter.

BusinessOutlookForthethirdquarterof2015,theCompanyexpectsitstotalnetrevenuetobebetweenRMB9.

1billionandRMB9.

3billion,representingayear-over-yeargrowthrateofapproximately71%to74%.

TheseforecastsreflecttheCompany'scurrentandpreliminaryviewonthemarketandoperationalconditions,whichissubjecttochange.

ExchangeRateThisannouncementcontainscurrencyconversionsofcertainRenminbiamountsintoU.

S.

dollarsatspecifiedratessolelyfortheconvenienceofthereader.

Unlessotherwisenoted,alltranslationsfrom8"ADS"meansAmericanDepositaryShare.

EffectiveNovember3,2014,theCompanychangeditsADStoClassAOrdinaryShare("Share")ratiofromoneADSrepresentingtwoordinarysharestofiveADSsrepresentingoneordinaryshare.

ThecomputationofGAAPandnon-GAAPincomeperdilutedADShavebeenadjustedretroactivelyforallperiodspresentedtoreflectthischange.

5RenminbitoU.

S.

dollarsaremadeatarateofRMB6.

2000toUS$1.

00,theeffectivenoonbuyingrateforJune30,2015assetforthintheH.

10statisticalreleaseoftheFederalReserveBoard.

ConferenceCallInformationTheCompanywillholdaconferencecallonTuesday,August11,2015at8:00amEasternTimeor8:00pmBeijingTimetodiscussitsfinancialresultsandoperatingperformanceforthesecondquarter2015.

UnitedStates:+1-845-675-0438InternationalTollFree:+1-855-500-8701ChinaDomestic:400-1200654HongKong:+852-3018-6776ConferenceID:#97698899ThereplaywillbeaccessiblethroughAugust19,2015bydialingthefollowingnumbers:UnitedStatesTollFree:+1-855-452-5696International:+61290034211ConferenceID:#97698899AliveandarchivedwebcastoftheconferencecallwillalsobeavailableattheCompany'sinvestorrelationswebsiteathttp://ir.

vip.

com.

AboutVipshopHoldingsLimitedVipshopHoldingsLimitedisaleadingonlinediscountretailerforbrandsinChina.

VipshopoffershighqualityandpopularbrandedproductstoconsumersthroughoutChinaatasignificantdiscounttoretailprices.

SinceitwasfoundedinAugust2008,theCompanyhasrapidlybuiltasizeableandgrowingbaseofcustomersandbrandpartners.

Formoreinformation,pleasevisitwww.

vip.

com.

SafeHarborStatementThisannouncementcontainsforward-lookingstatements.

Thesestatementsaremadeunderthe"safeharbor"provisionsoftheU.

S.

PrivateSecuritiesLitigationReformActof1995.

Theseforward-lookingstatementscanbeidentifiedbyterminologysuchas"will,""expects,""anticipates,""future,""intends,""plans,""believes,""estimates"andsimilarstatements.

Amongotherthings,thebusinessoutlookandquotationsfrommanagementinthisannouncement,aswellasVipshop'sstrategicandoperationalplans,containforward-lookingstatements.

Vipshopmayalsomakewrittenororalforward-lookingstatementsinitsperiodicreportstotheU.

S.

SecuritiesandExchangeCommission(the"SEC"),initsannualreporttoshareholders,inpressreleasesandotherwrittenmaterialsandinoralstatementsmadebyitsofficers,directorsoremployeestothirdparties.

Statementsthatarenothistoricalfacts,includingstatementsaboutVipshop'sbeliefsandexpectations,areforward-lookingstatements.

Forward-lookingstatementsinvolveinherentrisksanduncertainties.

Anumberoffactorscouldcauseactualresultstodiffermateriallyfromthosecontainedinanyforward-lookingstatement,includingbutnotlimitedtothefollowing:Vipshop'sgoalsandstrategies;Vipshop'sfuturebusinessdevelopment,resultsofoperationsandfinancialcondition;theexpectedgrowthoftheonlinediscountretailmarketinChina;Vipshop'sabilitytoattractcustomersandbrandpartnersandfurtherenhanceitsbrandrecognition;Vipshop'sexpectationsregardingdemandforandmarketacceptanceofflashsalesproductsandservices;competitioninthediscountretailindustry;fluctuationsingeneraleconomicandbusinessconditionsinChinaandassumptionsunderlyingorrelatedtoanyoftheforegoing.

FurtherinformationregardingtheseandotherrisksisincludedinVipshop'sfilingswiththeSEC.

Allinformationprovidedinthispressreleaseandintheattachmentsisasofthedate6ofthispressrelease,andVipshopdoesnotundertakeanyobligationtoupdateanyforward-lookingstatement,exceptasrequiredunderapplicablelaw.

UseofNon-GAAPFinancialMeasuresTheunauditedcondensedconsolidatedfinancialinformationispreparedinconformitywithaccountingprinciplesgenerallyacceptedintheUnitedStatesofAmerica("U.

S.

GAAP"),exceptthattheconsolidatedstatementofshareholders'equity,consolidatedstatementsofcashflows,andthedetailednotesrequiredbyAccountingStandardsCodification270InterimReporting("ASC270"),havenotbeenpresented.

Vipshopusesnon-GAAPnetincomeattributabletoVipshop'sshareholders,non-GAAPnetincomeperdilutedADS,non-GAAPincomefromoperations,non-GAAPnetincomemargin,andnon-GAAPoperatingincomemargin,eachofwhichisanon-GAAPfinancialmeasure.

Non-GAAPnetincomeattributabletoVipshop'sshareholdersisnetincomeattributabletoVipshop'sshareholdersexcludingshare-basedcompensationexpensesandamortizationofintangibleassetsresultingfromabusinessacquisitionandequitymethodinvestments.

Non-GAAPnetincomeperdilutedADSisnon-GAAPnetincomedividedbyweightedaveragenumberofdilutedADS.

Non-GAAPincomefromoperationsisincomefromoperationsexcludingshare-basedcompensationexpensesandamortizationofintangibleassetsresultingfromabusinessacquisition.

Non-GAAPoperatingincomemarginisnon-GAAPincomefromoperationsasapercentageoftotalnetrevenue.

Non-GAAPnetincomemarginisnon-GAAPnetincomeasapercentageoftotalnetrevenue.

TheCompanybelievesthatseparateanalysisandexclusionofthenon-cashimpactofshare-basedcompensationandamortizationofintangibleassetsaddsclaritytotheconstituentpartsofitsperformance.

TheCompanyreviewsthesenon-GAAPfinancialmeasurestogetherwithGAAPfinancialmeasurestoobtainabetterunderstandingofitsoperatingperformance.

Itusesthesenon-GAAPfinancialmeasuresforplanning,forecastingandmeasuringresultsagainsttheforecast.

TheCompanybelievesthatnon-GAAPfinancialmeasuresareusefulsupplementalinformationforinvestorsandanalyststoassessitsoperatingperformancewithouttheeffectofnon-cashshare-basedcompensationexpensesandamortizationofintangibleassets,whichhavebeenandwillcontinuetobesignificantrecurringexpensesinitsbusiness.

However,theuseofnon-GAAPfinancialmeasureshasmateriallimitationsasananalyticaltool.

Oneofthelimitationsofusingnon-GAAPfinancialmeasuresisthattheydonotincludeallitemsthatimpacttheCompany'snetincomefortheperiod.

Inaddition,becausenon-GAAPfinancialmeasuresarenotmeasuredinthesamemannerbyallcompanies,theymaynotbecomparabletoothersimilartitledmeasuresusedbyothercompanies.

Inlightoftheforegoinglimitations,youshouldnotconsidernon-GAAPfinancialmeasureinisolationfromorasanalternativetothefinancialmeasurepreparedinaccordancewithU.

S.

GAAP.

Thepresentationofthesenon-GAAPfinancialmeasuresisnotintendedtobeconsideredinisolationfrom,orasasubstitutefor,thefinancialinformationpreparedandpresentedinaccordancewithU.

S.

GAAP.

Formoreinformationonthesenon-GAAPfinancialmeasures,pleaseseethetablecaptioned"VipshopHoldingsLimitedReconciliationsofGAAPandNon-GAAPResults"attheendofthisrelease.

InvestorRelationsContactVipshopHoldingsLimitedMillicentTuTel:+86(20)2233-0732Email:IR@vipshop.

comICR,Inc.

JeremyPeruskiTel:+1(646)405-4866Email:IR@vipshop.

com7VipshopHoldingsLimitedCondensedConsolidatedStatementsofIncomeandComprehensiveIncome(Inthousands,exceptpersharedata)ThreeMonthsEndedJune30,2014June30,2015June30,2015RMB'000RMB'000USD'000(Unaudited)(Unaudited)(Unaudited)Productrevenues5,000,8448,829,7141,424,147Otherrevenues(1)78,042188,40830,388Totalnetrevenues5,078,8869,018,1221,454,535Costofgoodssold(3,818,868)(6,767,452)(1,091,525)Grossprofit1,260,0192,250,670363,010OperatingexpensesFulfillmentexpenses(2)(513,385)(819,612)(132,194)Marketingexpenses(274,208)(502,566)(81,059)Technologyandcontentexpenses(131,020)(245,695)(39,628)Generalandadministrativeexpenses(3)(225,910)(286,743)(46,249)Totaloperatingexpenses(1,144,524)(1,854,616)(299,130)Otherincome34,14441,7146,728Incomefromoperations149,639437,76870,608Interestexpenses(28,679)(16,981)(2,739)Interestincome82,30175,75012,218Exchangegain4,37719,9593,219Incomebeforeincometaxesandshareoflossofaffiliates207,638516,49683,306Incometaxexpense(4)(57,988)(112,603)(18,162)Shareoflossofaffiliates(11,184)(19,922)(3,213)Netincome138,466383,97161,931Netlossattributabletononcontrollinginterests23,07915,3202,471NetincomeattributabletoVipshop'sshareholders161,545399,29164,402Sharesusedincalculatingearningspershare(5):ClassAordinaryshares:—Basic96,704,29799,369,29599,369,295—Diluted102,917,277103,690,098103,690,098ClassBordinaryshares:—Basic16,510,35816,510,35816,510,358—Diluted16,510,35816,510,35816,510,358NetearningsperClassAshareNetincomeattributabletoVipshop'sshareholders——Basic1.

463.

450.

56NetincomeattributabletoVipshop'sshareholders——Diluted1.

373.

320.

54NetearningsperClassBshareNetincomeattributabletoVipshop'sshareholders——Basic1.

463.

450.

56NetincomeattributabletoVipshop'sshareholders——Diluted1.

373.

320.

548NetearningsperADS(1ordinaryshareequalsto5ADSs)NetincomeattributabletoVipshop'sshareholders——Basic0.

290.

690.

11NetincomeattributabletoVipshop'sshareholders——Diluted0.

270.

660.

11(1)Otherrevenuesprimarilyconsistofrevenuesfromproductpromotionandonlineadvertising,feeschargedtothird-partymerchantswhichtheCompanyprovidesplatformaccessforsalesoftheirproducts.

(2)Includingshippingandhandlingexpenses,whichamountedRMB245millionandRMB301millioninthethreemonthperiodsendedJune30,2014andJune30,2015,respectively.

(3)Includingamortizationofintangibleassetsresultingfromabusinessacquisition,whichamountedtoRMB62millionandRMB61millioninthethreemonthsperiodendedJune30,2014andJune30,2015,respectively.

(4)IncludedincometaxbenefitsofRMB15millionandRMB15millionrelatedtothereversalofdeferredtaxliabilities,whichwasrecognizedonthebusinssacquisitionofLefengforthethreemonthsperiodendedJune30,2014andJune30,2015,respectively.

(5)Authorizedsharecapitalarere-classifiedandre-designatedintoClassAordinarysharesandClassBordinaryshares,witheachClassAordinarysharebeingentitledtoonevoteandeachClassBordinarysharebeingentitledtotenvotesonallmattersthataresubjecttoshareholdervote.

Netincome138,466383,97161,931Othercomprehensiveincome,netoftax:Foreigncurrencytranslationadjustments(976)(15,797)(2,548)Unrealizedgainorlossofavailable-for-salessecurities(918)(148)Comprehensiveincome137,490367,25659,235Less:Comprehensivelossattributabletonon-controllinginterests(23,261)(16,273)(2,625)ComprehensiveincomeattributabletoVipshop'sshareholders160,751383,52961,860ThreeMonthsEndedJune30,2014June30,2015June30,2015RMB'000RMB'000USD'0009(Unaudited)(Unaudited)(Unaudited)Share-basedcompensationchargesincludedarefollowsFulfillmentexpenses2,2474,149669Marketingexpenses4,5064,176674Technologyandcontentexpenses27,05331,0855,014Generalandadministrativeexpenses22,32130,8084,969Total56,12770,21811,326VipshopHoldingsLimitedCondensedConsolidatedBalanceSheets(Inthousands,exceptpersharedata)December31,2014June30,2015June30,2015RMB'000RMB'000USD'000ASSETS(Unaudited)(Unaudited)(Unaudited)CURRENTASSETSCashandcashequivalents4,790,7514,430,522714,600Restrictedcash4009,7001,565Held-to-maturitysecurities3,768,3382,866,146462,282Accountsreceivable,net155,099419,85967,719Amountsduefromrelatedparties30,99120,8663,366Otherreceivables550,122645,762104,155Inventories3,588,3042,719,500438,628Advancetosuppliers81,95290,37514,577Prepaidexpenses21,34835,2885,692Deferredtaxassets233,149260,36541,994Totalcurrentassets13,220,45411,498,3831,854,578NON-CURRENTASSETS-Propertyandequipment,net1,911,4532,570,392414,579Depositsforpropertyandequipment207,509232,65737,525Prepaidlanduseright81,991169,28327,303Intangibleassets,net1,038,949902,776145,609Investmentinaffiliates287,390357,89457,725Otherinvestments102,792436,61370,42210Available-for-salesecuritiesinvestment,non-current61,8219,971Otherlong-termassets40,503104,23516,812Goodwill60,00064,81910,455Totalnon-currentassets3,730,5874,900,490790,401TOTALASSETS16,951,04116,398,8732,644,979LIABILTIESANDEQUITYCURRENTLIABILITIESAccountspayable(IncludingaccountspayableoftheVIEwithoutrecoursetotheCompanyofRMB7,490andRMB14,942asofDecember31,2014andJune30,2015,respectively)6,121,2564,740,239764,555Advancefromcustomers(IncludingadvancefromcustomersoftheVIEwithoutrecoursetotheCompanyofRMB1,217,429andRMB607,928asofDecember31,2014andJune30,2015,respectively)1,422,9351,243,044200,491Accruedexpensesandothercurrentliabilities(IncludingaccruedexpensesandothercurrentliabilitiesoftheVIEwithoutrecoursetotheCompanyofRMB944,097andRMB793,497asofDecember31,2014andJune30,2015,respectively)2,340,7552,311,201372,774Amountsduetorelatedparties(IncludingamountsduetorelatedpartiesoftheVIEwithoutrecoursetotheCompanyofRMB2,474andRMB33,497asofDecember31,2014andJune30,2015,respectively)75,784155,45225,073Deferredincome(IncludingdeferredincomeoftheVIEwithoutrecoursetotheCompanyofRMB178,920andRMB199,353asofDecember31,2014andJune30,2015,respectively)194,560292,68447,207Shorttermloans(IncludingshorttermloansoftheVIEwithoutrecoursetotheCompanyofnilasofDecember31,2014andJune30,2015)-6,000968Totalcurrentliabilities10,155,2908,748,6201,411,068NON-CURRENTLIABILITIESDeferredtaxliability242,697212,61634,293Convertibleseniornotes3,854,9853,868,137623,893Totalnon-currentliabilities4,097,6824,080,753658,186Totalliabilities14,252,97312,829,3732,069,254EQUITY:11ClassAordinaryshares(US$0.

0001parvalue,483,489,642sharesauthorized,and99,475,664and98,028,314sharesissuedandoutstandingasofJune30,2015andDecember31,2014,respectively)636410ClassBordinaryshares(US$0.

0001parvalue,16,510,358sharesauthorized,and16,510,358and16,510,358sharesissuedandoutstandingasofJune30,2015andDecember31,2014,respectively)11112Additionalpaid-incapital2,538,2172,679,358432,154Retainedearnings26,544793,345127,959Accumulatedothercomprehensiveincome(loss)(10,711)(11,555)(1,864)Non-controllinginterests143,944108,27717,464Totalshareholders'equity2,698,0683,569,500575,725TOTALLIABILITIESANDSHAREHOLDERS'EQUITY16,951,04116,398,8732,644,979--VipshopHoldingsLimitedReconciliationsofGAAPandNon-GAAPResultsThreeMonthsEndedJune30,2014June30,2015June30,2015RMB'000RMB'000USD'000(Unaudited)(Unaudited)(Unaudited)Incomefromoperations149,639437,76870,608Share-basedcompensationexpenses56,12770,21811,326Amortizationofintangibleassetsresultingfromabusinessacquisition61,22460,6289,779Non-GAAPincomefromoperations266,990568,61491,713Netincome138,466383,97161,931Share-basedcompensationexpenses56,12770,21811,326Amortizationofintangibleassetsresultingfromabusinessacquisitionandequitymethodinvestments(netoftax)57,05559,4349,586Non-GAAPnetincome251,648513,62382,843NetincomeattributabletoVipshop'sshareholders161,545399,29164,402Share-basedcompensationexpenses56,12770,21811,326Amortizationofintangibleassetsresultingfromabusinessacquisitionandequitymethodinvestments(excludenon-controllinginterestsandnetoftax)45,57648,1187,761Non-GAAPnetincomeattributabletoVipshop'sshareholders263,248517,62783,489Sharesusedincalculatingearningspershare:12Basiccommonshares:ClassAordinaryshares:—Basic96,704,29799,369,29599,369,295—Diluted102,917,277103,690,098103,690,098ClassBordinaryshares:—Basic16,510,35816,510,35816,510,358—Diluted16,510,35816,510,35816,510,358Non-GAAPnetincomeperClassAshareNon-GAAPnetincomeattributabletoVipshop'sshareholders——Basic2.

334.

470.

72Non-GAAPnetincomeattributabletoVipshop'sshareholders——Diluted2.

204.

310.

69Non-GAAPnetincomeperClassBshareNon-GAAPnetincomeattributabletoVipshop'sshareholders——Basic2.

334.

470.

72Non-GAAPnetincomeattributabletoVipshop'sshareholders——Diluted2.

204.

310.

69Non-GAAPnetincomeperADS(1ordinaryshareequalto5ADSs)Non-GAAPnetincomeattributabletoVipshop'sshareholders——Basic0.

470.

890.

14Non-GAAPnetincomeattributabletoVipshop'sshareholders——Diluted0.

440.

860.

14

- impactvip.com相关文档

- 被保险人vip.com

- 医学院vip.com

- 资料vip.com

- Skidvip.com

- 乳牙vip.com

- 达人vip.com

Vinahost - 越南VPS主机商月6美元 季付以上赠送时长最多半年

Vinahost,这个主机商还是第一次介绍到,翻看商家的介绍信息,是一家成立于2008年的老牌越南主机商,业务涵盖网站设计、域名、SSL证书、电子邮箱、虚拟主机、越南VPS、云计算、越南服务器出租以及设备托管等,机房主要在越南胡志明市的Viettle和VNPT数据中心,其中VNPT数据中心对于国内是三网直连,速度优。类似很多海外主机商一样,希望拓展自己的业务,必须要降价优惠或者增加机房迎合需求用户...

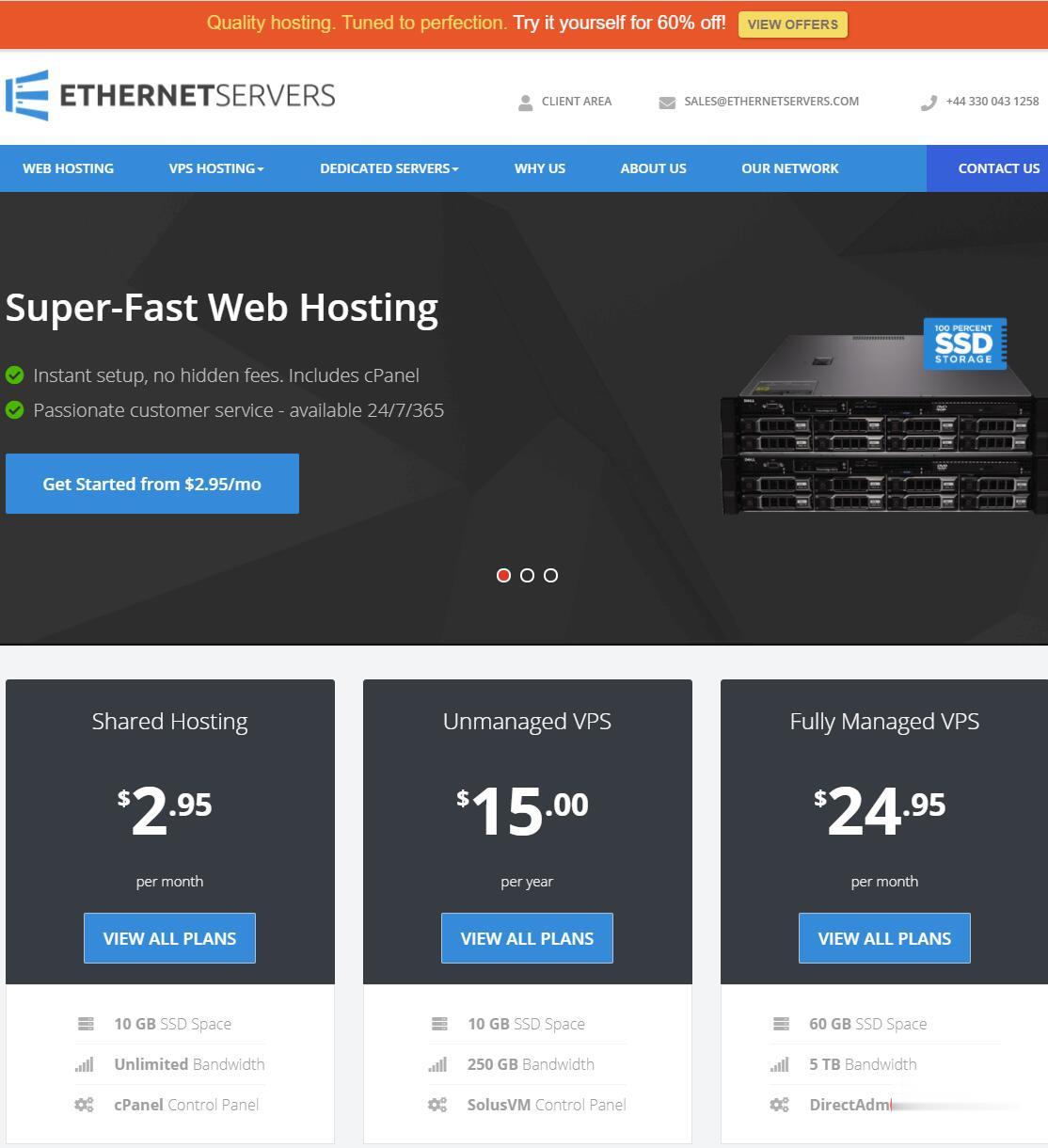

EtherNetservers年付仅10美元,美国洛杉矶VPS/1核512M内存10GB硬盘1Gpbs端口月流量500GB/2个IP

EtherNetservers是一家成立于2013年的英国主机商,提供基于OpenVZ和KVM架构的VPS,数据中心包括美国洛杉矶、新泽西和杰克逊维尔,商家支持使用PayPal、支付宝等付款方式,提供 60 天退款保证,这在IDC行业来说很少见,也可见商家对自家产品很有信心。有需要便宜VPS、多IP VPS的朋友可以关注一下。优惠码SUMMER-VPS-15 (终身 15% 的折扣)SUMMER-...

NameCheap黑色星期五和网络礼拜一

如果我们较早关注NameCheap商家的朋友应该记得前几年商家黑色星期五和网络星期一的时候大促采用的闪购活动,每一个小时轮番变化一次促销活动而且限量的。那时候会导致拥挤官网打不开迟缓的问题。从去年开始,包括今年,NameCheap商家比较直接的告诉你黑色星期五和网络星期一为期6天的活动。没有给你限量的活动,只有限时六天,这个是到11月29日。如果我们有需要新注册、转入域名的可以参加,优惠力度还是比...

vip.com为你推荐

-

有人在认真做事计算机网络实验系统Deviceios5itunes备份如何用iTunes备份iPhone127.0.0.1DNS老是被修改为127.0.0.1,这是为什么?用itunes备份iphone怎么从itunes备份恢复x-routerX-TRAlL是什么意思ms17-010win10蒙林北冬虫夏草酒·10年原浆1*6 500ml 176,176是一瓶的价格还是一箱的价格联通版iphone4s怎么区分iphone4s电信版和联通版联通iphone4联通iphone4怎么样,好不好用?