countrybaht

baht 时间:2021-01-18 阅读:()

1TrueGroupreportedanetprofitofBaht5.

4billioninthefourthquarterandBaht2.

3billionin2017drivenbyrecord-highrevenueandEBITDA,corporate-widecostandproductivityinitiatives,andthesuccessfulassetdivestmenttotheDigitalTelecommunicationsInfrastructureFund(DIF)pavingthewayforTruetoachievesustainableprofitabilityanddividendpayments.

On28February2018,True'sboardofdirectorsapproveddividendpaymentsfromTrue'sfull-year2017financialperformancetotalingapproximatelyBaht1billion(Baht0.

031pershare).

TheGroup'songoingcommitmenttoprovideconsumerswithsuperiortelecommunicationsnetworks,value-drivenconvergenceanddigitalofferings,andimprovingserviceexperiencewerekeycontributorsforitssolidrevenueandsubscribergrowth.

Atthesametime,TrueGroupfocusedheavilyoncostandproductivityinitiativesthroughouttheyear.

These,combinedwiththegainfromassetdivestmenttoDIFdroveitsEBITDAup59.

2%YoYtoBaht39.

9billion.

ExcludingtheeffectoftheassetdivestmenttoDIF,EBITDAgrew36%YoYtoBaht34billionwithEBITDAmarginonservicerevenueexpandingbymorethan600basispointsfrom29.

0%inayearearlierto35.

2%in2017.

In2017,theThaimobileindustrywascompetitivebutremainedrationalwithoperatorsfocusingon4Gnetworkexpansion,attractivedatapriceplanshighlightingspeedsand4Gservices,andcontentbundling.

Avarietyofdevice-bundledcampaignswasalsointroducedparticularlytoencourageprepaiduserstoupgradetopostpaidpackageswhiletheoverallprepaidsubsidieswerescaleddown.

TrueMoveHsignificantlyoutgrewtheindustrythroughout2017andwastheonlyoperatorrecordingpositivenetaddsof2.

7millionwhiletheothertwomajorplayersreportedcombinednetsubscriberlossof2.

8million.

ThiswasdrivenbyTrueMoveH's4.

5G/4Gsuperiorityandoverwhelmingresponsetoitsbundledpropositionsfrombothpostpaidandprepaidsegments.

TrueMoveHexpandeditssubscriberbaseto27.

2million,ofwhich20.

3millionwereprepaidand6.

9millionwerepostpaidusers.

Thisdroveitsservicerevenueup17.

3%YoYin2017,contrastingwithonly2.

1%YoYgrowthofitsmajorcompetitorscombined,andactedasacatalysttopushtheoverallindustry'sservicerevenuetogrow5.

7%YoY,thehighestyearlygrowthratesince2014.

Thepositivegrowthtrendwillcontinueasdataconsumptionkeepsrising.

Thailand'sbroadbandinternetmarketgrewhealthilyin2017asoperatorscontinuedtoexpandtheirfibernetworksandemphasizedonqualitysubscriptionwithconvergencepropositionswhilediscountcampaignsweretaperedoff.

TrueOnlineacceleratedexpansionofitsfiberfootprintbothintheBangkokMetropolitanArea(BMA)andupcountrywhileaddingmorevalueforconsumerswithspeedandtechnologyupgradestomeettheirrapidlygrowingdemandforfasteronlinetransmission.

TheGroupcontinuestosupportthenationalbroadbandrolloutinitiativeandbridgethedigitaldividewithinthecountrybyincreasingitsbroadbandnetworktoreachover13millionhomespassednationwide.

Theseresultedinsoliddouble-digitbroadbandrevenueandsubscribergrowthandsealeditsleadershipinthebroadbandinternetmarket.

TrueOnlinerecorded385knetaddsin2017andexpandeditsbroadbandsubscriberbaseto3.

2million,allofwhichwereonFTTxnetwork.

TrueVisionsremainscommittedtoenhancingitsofferingsthroughacomprehensiverangeofhigh-qualitycontent,livebroadcastingandHDviewingexperiencewhiledevelopingitsown-producedchannelstomatchThaiconsumers'preferences.

ThisstrengthandtheGroup'scompetitivebundledpackagesboostedTrueVisions'subscriptionrevenueandpayingsubscriberbase.

TrueVisionsended2017withatotalcustomerbaseof4.

0millionhouseholds.

BysharingitsunrivaledcontentacrossTrueGroup'smultipleplatformsincludingwiredandwirelessbroadband,televisionanddigitalmediaplatforms,theGroupideallyfulfillstoday'sconsumerdemandtoaccesscontentanytime,anywhere,andonanydevices.

Inadditiontostrengtheningcorebusinesses,TrueGrouphasplacedimportanceondisruptiveanddigital-relatedbusinessesaimingtoprovidethebestpossibledigitalandcontentplatformsthatfulfillconsumers'demandsandlifestyles.

TheseincludeInternetofThingsandotherinnovativeofferingsaswellasthedevelopmentofTrueID,aone-stopinnovativeapplicationforavarietyofcontent,lifestylesandspecialprivileges.

TheGroupalsofocusesonBigDataandArtificialIntelligencetechnologies,whichprovidedata-drivenbusinessintelligencetobeanalyzedforcompetitiveadvantagesandbetterrespondingtoconsumers'needs.

ThesewellpositionTrueGrouptoamplifygrowthandstayatthetopofconsumers'mind.

Lookingforwardto2018TrueGroup'scommitmenttonetworkandserviceexcellence,disruptiveanddigitalbusinesseswhilecultivatingadigitalmindsetandcreativitywithinthecompanywillenableittoalwayskeeppacewithchangesinconsumers'preferencesandadvancementsintechnology.

Thesedevelopmentsandconsumers'constantly-growingdemandsfortelecommunicationsanddigitalservicesintheThailand4.

0eraareexpectedtodrivesolidgrowthofTrueGroup.

TheGrouptargetsalowdouble-digitgrowthforconsolidatedservicerevenuein2018.

Thisincrementalscale,combinedwithcontinuedfocusoncostandproductivityinitiatives,shouldturnitsnetprofitspositiveexcludingtheone-timeimpactsoftheplannedsaleofadditionalassetstoDIF.

The2018cashCAPEXexcludinglicensefeepaymentisexpectedtobearoundthesamelevelas2017.

TrueCorporationPLC.

2017MD&AInvestorRelationsOfficeir_office@truecorp.

co.

th(66)2858-2515,http://www.

truecorp.

co.

thExecutiveSummary:Consolidatedresults2Segmentresults3RevenueProfile4BalanceSheet5Detailedfinancial&operationalstatistics6Contents:Remark:EBITDAmarginreferstomarginonservicerevenueexcludingcontributionfromproductsalesandDIFtransactions2TrueCorporationPLC.

Consolidatedresults:NormalizedStatementsofIncome(Loss)-ConsolidatedTrueGroup'sconsolidatedservicerevenueincreased10.

2%YoYtoBaht97.

0billionduetosignificantgrowthofboththecellularandconsumerbroadbandbusinesseswhoserevenueandsubscriberbaseincreasinginasoliddouble-digitrate.

Thisstrongperformancewasachieveddespiteimpactfromthefixed-linevoiceconcessionendinginOctober2017astheGroup'snetworkstrengthandexpandedfootprintcontinuedtomeetcustomers'growingconsumptionofdataanddigitalcontent.

Productsalessurged40.

6%YoYtoBaht23.

7billiononassetdivestmenttoDIFandcontinuedstrongresponsetotheGroup'sdevice-bundlingcampaigns.

ExcludingDIFtransactions,productsalesgrew3.

4%fromthepreviousyeartoBaht17.

4billion.

Regulatorycostsdecreased3.

9%YoYtoBaht3.

3billionduetolowerrevenuesharingrelatedtothetraditionalfixed-linephoneservice,whoseconcessionendedinOctober,andpositiveimpactfromthenewratesofUSOandlicensefeeannouncedinMayandDecemberrespectively.

Thefull-yearpositiveimpactfromthenewprogressiverateoflicensefeewasbookedin4Q17.

Coreoperatingexpense(comprisingcostofprovidingservicesexcludingICandotherS&A)increased2.

6%YoYtoBaht75.

0billionduetohigherexpensesrelatedtonetworkandpersonnel.

TheGroup'songoingfocusoncostsavingsandproductivitymeasuresresultedin8.

2%YoYdropofSG&Aexcludingdepreciationandamortizationin4Q17.

EBITDAsurged59.

2%YoYtoBaht39.

9billion.

ExcludingtheimpactfromassetdivestmenttoDIF,EBITDAexpanded36%YoYtoBaht34.

0billionasrevenuecontinuedtogrowwhilecostswerewellcontained.

Continuednetworkandserviceexpansionaswellasfull-yearimpactofthe900MHzlicenseamortizationdrovedepreciationandamortizationexpensestoBaht33.

5billion.

Interestexpense(net)increased27%YoYtoBaht5.

4billionduetoadditionalborrowingsforbusinessexpansionandworkingcapitalrequirements.

Debtrepaymentin4Q17resultedin10.

5%declineofnetinterestexpensecomparedtothepreviousquarter.

IncometaxexpenseincreasedfromBaht490millioninthepreviousyeartoBaht1.

3billionin2017mainlyduetodeferredtaxexpensesrelatedtoassettransactionswithDIF.

ThefirsttrancheofassetdivestmenttoDIFwascompletedin4Q17.

ImpacttotheGroup'snetincomewasapproximatelyBaht6.

5billion;apartofthisgainwasrecordedunderotherincometotalingBaht2.

4billionwhiletherestwasrecordedundernetproductsales,rentalexpenseanddeferredtax.

TheseresultedinconsolidatednetprofittoshareholdersoftheparentcompanytotalingBaht2.

3billionin2017.

GroupservicerevenueexclIC3TrueMoveHTrueMoveHsignificantlyoutgrewtheindustrythroughout2017andwastheonlyoperatorreportingpositivenetadds.

Itsexpandingsubscriberbaseanddatarevenueforbothpostpaidandprepaidsegmentsdroveitsservicerevenueup17.

3%YoYtoBaht67.

9billion.

Non-voicerevenuegrew24.

7%YoYtoBaht42.

4billion,representing62%ofTrueMoveH'sservicerevenuecomparedto59%inthepreviousyear,followingcontinuedsuccessofits4G,data-drivenanddevice-bundlingcampaigns.

Voicerevenueincreased1.

9%YoYtoBaht21.

2billionasTrueMoveH'ssubscribergrowthanditsstrongerpresenceinthemasssegmentoutpacedconsumers'risingtrendtowardsdataandonlinecommunications.

RevenuefrominternationalroamingandotherserviceswasBaht4.

3billion,increasingYoYpartlyduetohigherinboundroamingrevenuegivenmoretouristarrivals.

TrueCorporationPLC.

TrueMoveHcustomersandblendedARPUTrueOnline'sservicerevenuewasBaht32.

2billion,increasing16.

6%YoYonstrongbroadbandinternetgrowthandintercompanyrevenuesrelatedtoO&Mserviceswhichwerereportedunderotherservicerevenue;excludingthisandimpactfromthe2Gtransmissionnetworkshutdownsince3Q16,TrueOnline'sservicerevenuegrew3.

4%YoY.

Fixed-linevoicerevenuedeclinedtoBaht2.

5billion,comparedtoBaht4.

7billioninayearearlier,followingconsumers'behaviorshifttowardsmobileandonlinecommunicationsaswellasfixed-lineconcessionendinginOctoberwhichresultedinlowerrevenueandcostsrelatedtothetraditionalvoiceservices.

RevenuesfromBroadband,InternetandBusinessDataServiceincreased9.

8%YoYtoBaht23.

1billionduetostronggrowthinbothconsumerandcorporatesegmentsastheGroupcontinuedtoexpanditsFTTHfootprintwhileaddingvaluethroughconvergenceandcomprehensivesolutions.

Duringthefirstninemonthsof2017,theGroupfocusedheavilyonupgradingbroadbandcoppercustomerstothelicensedfibernetwork.

Withthatbehindus,TrueOnline'srevenuesfrombroadband,internetanddataservicesgrew16.

7%YoYand5.

4%QoQin4Q17withstrongquarterlynetaddsof112,781.

Itsbroadbandsubscriberbaseincreasedto3.

2million,allofwhichwereonFTTxnetwork.

TrueOnlineTrueVisions'servicerevenuewasBaht12.

2billion,flat(+0.

1%)YoYassubscriptionandadvertisinggrowthoffsetlowermusicentertainmentandotherrevenues.

Subscriptionandinstallationrevenueincreased2.

2%YoYtoBaht8.

2billion,representing67%ofTrueVisions'servicerevenuecomparedto65%ayearearlier,onpositiveresponsetotheGroup'sconvergenceandmass-tierpackages.

ThisdroveTrueVisions'payingsubscriberbaseupto2.

2millionwithyearlynetaddsof176k.

Advertisingrevenueincreased2.

1%YoYtoBaht1.

8billioncontrastingwithindustry'sdecliningtrend.

Musicentertainmentandotherrevenuesdecreased8.

4%YoYtoBaht2.

3billionfollowingtheGroup'sstrategytotonedownlow-marginevents.

TrueVisionsBroadbandcustomersandARPUTrueVisionscustomersandARPURemark:TrueVisions'payingsubscribers=premiumpackage+standardpackage4RevenueprofileTrueCorporationPLC.

Remark:TrueMoveH'sproductsalesexcludingDIFtransactionswereBt5.

0bnin4Q17andBt17.

3bnin2017TrueOnline'sproductsalesexcludingDIFtransactionswereBt21mnin4Q17andBt111mnin20175CashFlowTrueGroup'sassetsincreased3.

6%fromtheendof2016toBaht465.

3billionmainlyduetohigherproperty,plantandequipment.

Property,plantandequipment(net)increased22.

1%fromtheendof2016toBaht175.

5billionasTrueGroupcontinuedtoexpanditscellularandbroadbandfootprint.

Intangibleassets(net)decreased7.

4%fromtheendof2016toBaht129.

4billionprimarilyduetoamortizationofthemobilespectrumlicensesduringtheperiod.

Investmentinassociatesandinterestsinjointventures(net)declinedfromBaht18.

2billionattheendof2016toBaht16.

5billiondrivenpartlybydividendreceivedfromDIF(seemoredetailinthenotetofinancialstatementssection20.

2).

Tradeaccountreceivables(net)increasedtoBaht49.

4billiondrivenbytheGroup'scontinuedbusinessexpansionanddomesticroamingreceivable.

TrueGroup'stotalliabilitiesincreased4.

4%fromtheendof2016toBaht331.

1billionmainlyduetohigherinterestbearingdebt(short-termandlong-termborrowingsexcludingfinancialleases)whichreachedBaht119.

5billioninordertosupporttheGroup'sbusinessexpansionincludingworkingcapitalrequirements.

DebtrepaymentduringQ4resultedin6%QoQdropofinterestbearingdebt.

Tradeaccountspayablerosefromtheendof2016toBaht67.

5billiondrivenbytheGroup'sbusinessexpansionwithattractivevendorfinancingterms.

Shareholders'equitygrewfromBaht131.

7billionattheendof2016toBaht134.

2billionduetonetprofitachievedin2017.

TrueGroup'sprimarycapitalresourcesfortheyear2017werecashflowsfromfinancingactivitiestotalingBaht5.

1billion,decliningfromthepreviousyear'shighbasewiththecapitalincrease.

Cashflowsfromoperatingactivities(net)in2017wasBaht5.

0billion(Baht10.

2billionbeforeinterestandtaxpayments),decreasingfromthepreviousyearduetoworkingcapitalrequirementsandcertainsettlementsrelatedtotheHSPAagreementwithCAT.

Cashflowsusedininvestingactivitiesin2017wasBaht42.

1billion,decreasingmainlyonproceedsfromassetdivestmenttoDIFinthefourthquarterof2017.

CashCAPEXin2017wasBaht47.

6billionandmainlyusedfortheGroup'swiredandwirelessbroadbandnetworks;excludinglicensefeepayments,cashCAPEXwasapproximatelyBaht37billion,belowtheBaht47billionguidance.

BalanceSheetTrueCorporationPLC.

6Selectedfinancial&operationalstatisticsTrueCorporationPLC.

4billioninthefourthquarterandBaht2.

3billionin2017drivenbyrecord-highrevenueandEBITDA,corporate-widecostandproductivityinitiatives,andthesuccessfulassetdivestmenttotheDigitalTelecommunicationsInfrastructureFund(DIF)pavingthewayforTruetoachievesustainableprofitabilityanddividendpayments.

On28February2018,True'sboardofdirectorsapproveddividendpaymentsfromTrue'sfull-year2017financialperformancetotalingapproximatelyBaht1billion(Baht0.

031pershare).

TheGroup'songoingcommitmenttoprovideconsumerswithsuperiortelecommunicationsnetworks,value-drivenconvergenceanddigitalofferings,andimprovingserviceexperiencewerekeycontributorsforitssolidrevenueandsubscribergrowth.

Atthesametime,TrueGroupfocusedheavilyoncostandproductivityinitiativesthroughouttheyear.

These,combinedwiththegainfromassetdivestmenttoDIFdroveitsEBITDAup59.

2%YoYtoBaht39.

9billion.

ExcludingtheeffectoftheassetdivestmenttoDIF,EBITDAgrew36%YoYtoBaht34billionwithEBITDAmarginonservicerevenueexpandingbymorethan600basispointsfrom29.

0%inayearearlierto35.

2%in2017.

In2017,theThaimobileindustrywascompetitivebutremainedrationalwithoperatorsfocusingon4Gnetworkexpansion,attractivedatapriceplanshighlightingspeedsand4Gservices,andcontentbundling.

Avarietyofdevice-bundledcampaignswasalsointroducedparticularlytoencourageprepaiduserstoupgradetopostpaidpackageswhiletheoverallprepaidsubsidieswerescaleddown.

TrueMoveHsignificantlyoutgrewtheindustrythroughout2017andwastheonlyoperatorrecordingpositivenetaddsof2.

7millionwhiletheothertwomajorplayersreportedcombinednetsubscriberlossof2.

8million.

ThiswasdrivenbyTrueMoveH's4.

5G/4Gsuperiorityandoverwhelmingresponsetoitsbundledpropositionsfrombothpostpaidandprepaidsegments.

TrueMoveHexpandeditssubscriberbaseto27.

2million,ofwhich20.

3millionwereprepaidand6.

9millionwerepostpaidusers.

Thisdroveitsservicerevenueup17.

3%YoYin2017,contrastingwithonly2.

1%YoYgrowthofitsmajorcompetitorscombined,andactedasacatalysttopushtheoverallindustry'sservicerevenuetogrow5.

7%YoY,thehighestyearlygrowthratesince2014.

Thepositivegrowthtrendwillcontinueasdataconsumptionkeepsrising.

Thailand'sbroadbandinternetmarketgrewhealthilyin2017asoperatorscontinuedtoexpandtheirfibernetworksandemphasizedonqualitysubscriptionwithconvergencepropositionswhilediscountcampaignsweretaperedoff.

TrueOnlineacceleratedexpansionofitsfiberfootprintbothintheBangkokMetropolitanArea(BMA)andupcountrywhileaddingmorevalueforconsumerswithspeedandtechnologyupgradestomeettheirrapidlygrowingdemandforfasteronlinetransmission.

TheGroupcontinuestosupportthenationalbroadbandrolloutinitiativeandbridgethedigitaldividewithinthecountrybyincreasingitsbroadbandnetworktoreachover13millionhomespassednationwide.

Theseresultedinsoliddouble-digitbroadbandrevenueandsubscribergrowthandsealeditsleadershipinthebroadbandinternetmarket.

TrueOnlinerecorded385knetaddsin2017andexpandeditsbroadbandsubscriberbaseto3.

2million,allofwhichwereonFTTxnetwork.

TrueVisionsremainscommittedtoenhancingitsofferingsthroughacomprehensiverangeofhigh-qualitycontent,livebroadcastingandHDviewingexperiencewhiledevelopingitsown-producedchannelstomatchThaiconsumers'preferences.

ThisstrengthandtheGroup'scompetitivebundledpackagesboostedTrueVisions'subscriptionrevenueandpayingsubscriberbase.

TrueVisionsended2017withatotalcustomerbaseof4.

0millionhouseholds.

BysharingitsunrivaledcontentacrossTrueGroup'smultipleplatformsincludingwiredandwirelessbroadband,televisionanddigitalmediaplatforms,theGroupideallyfulfillstoday'sconsumerdemandtoaccesscontentanytime,anywhere,andonanydevices.

Inadditiontostrengtheningcorebusinesses,TrueGrouphasplacedimportanceondisruptiveanddigital-relatedbusinessesaimingtoprovidethebestpossibledigitalandcontentplatformsthatfulfillconsumers'demandsandlifestyles.

TheseincludeInternetofThingsandotherinnovativeofferingsaswellasthedevelopmentofTrueID,aone-stopinnovativeapplicationforavarietyofcontent,lifestylesandspecialprivileges.

TheGroupalsofocusesonBigDataandArtificialIntelligencetechnologies,whichprovidedata-drivenbusinessintelligencetobeanalyzedforcompetitiveadvantagesandbetterrespondingtoconsumers'needs.

ThesewellpositionTrueGrouptoamplifygrowthandstayatthetopofconsumers'mind.

Lookingforwardto2018TrueGroup'scommitmenttonetworkandserviceexcellence,disruptiveanddigitalbusinesseswhilecultivatingadigitalmindsetandcreativitywithinthecompanywillenableittoalwayskeeppacewithchangesinconsumers'preferencesandadvancementsintechnology.

Thesedevelopmentsandconsumers'constantly-growingdemandsfortelecommunicationsanddigitalservicesintheThailand4.

0eraareexpectedtodrivesolidgrowthofTrueGroup.

TheGrouptargetsalowdouble-digitgrowthforconsolidatedservicerevenuein2018.

Thisincrementalscale,combinedwithcontinuedfocusoncostandproductivityinitiatives,shouldturnitsnetprofitspositiveexcludingtheone-timeimpactsoftheplannedsaleofadditionalassetstoDIF.

The2018cashCAPEXexcludinglicensefeepaymentisexpectedtobearoundthesamelevelas2017.

TrueCorporationPLC.

2017MD&AInvestorRelationsOfficeir_office@truecorp.

co.

th(66)2858-2515,http://www.

truecorp.

co.

thExecutiveSummary:Consolidatedresults2Segmentresults3RevenueProfile4BalanceSheet5Detailedfinancial&operationalstatistics6Contents:Remark:EBITDAmarginreferstomarginonservicerevenueexcludingcontributionfromproductsalesandDIFtransactions2TrueCorporationPLC.

Consolidatedresults:NormalizedStatementsofIncome(Loss)-ConsolidatedTrueGroup'sconsolidatedservicerevenueincreased10.

2%YoYtoBaht97.

0billionduetosignificantgrowthofboththecellularandconsumerbroadbandbusinesseswhoserevenueandsubscriberbaseincreasinginasoliddouble-digitrate.

Thisstrongperformancewasachieveddespiteimpactfromthefixed-linevoiceconcessionendinginOctober2017astheGroup'snetworkstrengthandexpandedfootprintcontinuedtomeetcustomers'growingconsumptionofdataanddigitalcontent.

Productsalessurged40.

6%YoYtoBaht23.

7billiononassetdivestmenttoDIFandcontinuedstrongresponsetotheGroup'sdevice-bundlingcampaigns.

ExcludingDIFtransactions,productsalesgrew3.

4%fromthepreviousyeartoBaht17.

4billion.

Regulatorycostsdecreased3.

9%YoYtoBaht3.

3billionduetolowerrevenuesharingrelatedtothetraditionalfixed-linephoneservice,whoseconcessionendedinOctober,andpositiveimpactfromthenewratesofUSOandlicensefeeannouncedinMayandDecemberrespectively.

Thefull-yearpositiveimpactfromthenewprogressiverateoflicensefeewasbookedin4Q17.

Coreoperatingexpense(comprisingcostofprovidingservicesexcludingICandotherS&A)increased2.

6%YoYtoBaht75.

0billionduetohigherexpensesrelatedtonetworkandpersonnel.

TheGroup'songoingfocusoncostsavingsandproductivitymeasuresresultedin8.

2%YoYdropofSG&Aexcludingdepreciationandamortizationin4Q17.

EBITDAsurged59.

2%YoYtoBaht39.

9billion.

ExcludingtheimpactfromassetdivestmenttoDIF,EBITDAexpanded36%YoYtoBaht34.

0billionasrevenuecontinuedtogrowwhilecostswerewellcontained.

Continuednetworkandserviceexpansionaswellasfull-yearimpactofthe900MHzlicenseamortizationdrovedepreciationandamortizationexpensestoBaht33.

5billion.

Interestexpense(net)increased27%YoYtoBaht5.

4billionduetoadditionalborrowingsforbusinessexpansionandworkingcapitalrequirements.

Debtrepaymentin4Q17resultedin10.

5%declineofnetinterestexpensecomparedtothepreviousquarter.

IncometaxexpenseincreasedfromBaht490millioninthepreviousyeartoBaht1.

3billionin2017mainlyduetodeferredtaxexpensesrelatedtoassettransactionswithDIF.

ThefirsttrancheofassetdivestmenttoDIFwascompletedin4Q17.

ImpacttotheGroup'snetincomewasapproximatelyBaht6.

5billion;apartofthisgainwasrecordedunderotherincometotalingBaht2.

4billionwhiletherestwasrecordedundernetproductsales,rentalexpenseanddeferredtax.

TheseresultedinconsolidatednetprofittoshareholdersoftheparentcompanytotalingBaht2.

3billionin2017.

GroupservicerevenueexclIC3TrueMoveHTrueMoveHsignificantlyoutgrewtheindustrythroughout2017andwastheonlyoperatorreportingpositivenetadds.

Itsexpandingsubscriberbaseanddatarevenueforbothpostpaidandprepaidsegmentsdroveitsservicerevenueup17.

3%YoYtoBaht67.

9billion.

Non-voicerevenuegrew24.

7%YoYtoBaht42.

4billion,representing62%ofTrueMoveH'sservicerevenuecomparedto59%inthepreviousyear,followingcontinuedsuccessofits4G,data-drivenanddevice-bundlingcampaigns.

Voicerevenueincreased1.

9%YoYtoBaht21.

2billionasTrueMoveH'ssubscribergrowthanditsstrongerpresenceinthemasssegmentoutpacedconsumers'risingtrendtowardsdataandonlinecommunications.

RevenuefrominternationalroamingandotherserviceswasBaht4.

3billion,increasingYoYpartlyduetohigherinboundroamingrevenuegivenmoretouristarrivals.

TrueCorporationPLC.

TrueMoveHcustomersandblendedARPUTrueOnline'sservicerevenuewasBaht32.

2billion,increasing16.

6%YoYonstrongbroadbandinternetgrowthandintercompanyrevenuesrelatedtoO&Mserviceswhichwerereportedunderotherservicerevenue;excludingthisandimpactfromthe2Gtransmissionnetworkshutdownsince3Q16,TrueOnline'sservicerevenuegrew3.

4%YoY.

Fixed-linevoicerevenuedeclinedtoBaht2.

5billion,comparedtoBaht4.

7billioninayearearlier,followingconsumers'behaviorshifttowardsmobileandonlinecommunicationsaswellasfixed-lineconcessionendinginOctoberwhichresultedinlowerrevenueandcostsrelatedtothetraditionalvoiceservices.

RevenuesfromBroadband,InternetandBusinessDataServiceincreased9.

8%YoYtoBaht23.

1billionduetostronggrowthinbothconsumerandcorporatesegmentsastheGroupcontinuedtoexpanditsFTTHfootprintwhileaddingvaluethroughconvergenceandcomprehensivesolutions.

Duringthefirstninemonthsof2017,theGroupfocusedheavilyonupgradingbroadbandcoppercustomerstothelicensedfibernetwork.

Withthatbehindus,TrueOnline'srevenuesfrombroadband,internetanddataservicesgrew16.

7%YoYand5.

4%QoQin4Q17withstrongquarterlynetaddsof112,781.

Itsbroadbandsubscriberbaseincreasedto3.

2million,allofwhichwereonFTTxnetwork.

TrueOnlineTrueVisions'servicerevenuewasBaht12.

2billion,flat(+0.

1%)YoYassubscriptionandadvertisinggrowthoffsetlowermusicentertainmentandotherrevenues.

Subscriptionandinstallationrevenueincreased2.

2%YoYtoBaht8.

2billion,representing67%ofTrueVisions'servicerevenuecomparedto65%ayearearlier,onpositiveresponsetotheGroup'sconvergenceandmass-tierpackages.

ThisdroveTrueVisions'payingsubscriberbaseupto2.

2millionwithyearlynetaddsof176k.

Advertisingrevenueincreased2.

1%YoYtoBaht1.

8billioncontrastingwithindustry'sdecliningtrend.

Musicentertainmentandotherrevenuesdecreased8.

4%YoYtoBaht2.

3billionfollowingtheGroup'sstrategytotonedownlow-marginevents.

TrueVisionsBroadbandcustomersandARPUTrueVisionscustomersandARPURemark:TrueVisions'payingsubscribers=premiumpackage+standardpackage4RevenueprofileTrueCorporationPLC.

Remark:TrueMoveH'sproductsalesexcludingDIFtransactionswereBt5.

0bnin4Q17andBt17.

3bnin2017TrueOnline'sproductsalesexcludingDIFtransactionswereBt21mnin4Q17andBt111mnin20175CashFlowTrueGroup'sassetsincreased3.

6%fromtheendof2016toBaht465.

3billionmainlyduetohigherproperty,plantandequipment.

Property,plantandequipment(net)increased22.

1%fromtheendof2016toBaht175.

5billionasTrueGroupcontinuedtoexpanditscellularandbroadbandfootprint.

Intangibleassets(net)decreased7.

4%fromtheendof2016toBaht129.

4billionprimarilyduetoamortizationofthemobilespectrumlicensesduringtheperiod.

Investmentinassociatesandinterestsinjointventures(net)declinedfromBaht18.

2billionattheendof2016toBaht16.

5billiondrivenpartlybydividendreceivedfromDIF(seemoredetailinthenotetofinancialstatementssection20.

2).

Tradeaccountreceivables(net)increasedtoBaht49.

4billiondrivenbytheGroup'scontinuedbusinessexpansionanddomesticroamingreceivable.

TrueGroup'stotalliabilitiesincreased4.

4%fromtheendof2016toBaht331.

1billionmainlyduetohigherinterestbearingdebt(short-termandlong-termborrowingsexcludingfinancialleases)whichreachedBaht119.

5billioninordertosupporttheGroup'sbusinessexpansionincludingworkingcapitalrequirements.

DebtrepaymentduringQ4resultedin6%QoQdropofinterestbearingdebt.

Tradeaccountspayablerosefromtheendof2016toBaht67.

5billiondrivenbytheGroup'sbusinessexpansionwithattractivevendorfinancingterms.

Shareholders'equitygrewfromBaht131.

7billionattheendof2016toBaht134.

2billionduetonetprofitachievedin2017.

TrueGroup'sprimarycapitalresourcesfortheyear2017werecashflowsfromfinancingactivitiestotalingBaht5.

1billion,decliningfromthepreviousyear'shighbasewiththecapitalincrease.

Cashflowsfromoperatingactivities(net)in2017wasBaht5.

0billion(Baht10.

2billionbeforeinterestandtaxpayments),decreasingfromthepreviousyearduetoworkingcapitalrequirementsandcertainsettlementsrelatedtotheHSPAagreementwithCAT.

Cashflowsusedininvestingactivitiesin2017wasBaht42.

1billion,decreasingmainlyonproceedsfromassetdivestmenttoDIFinthefourthquarterof2017.

CashCAPEXin2017wasBaht47.

6billionandmainlyusedfortheGroup'swiredandwirelessbroadbandnetworks;excludinglicensefeepayments,cashCAPEXwasapproximatelyBaht37billion,belowtheBaht47billionguidance.

BalanceSheetTrueCorporationPLC.

6Selectedfinancial&operationalstatisticsTrueCorporationPLC.

月费$389,RackNerd美国大硬盘独立服务器

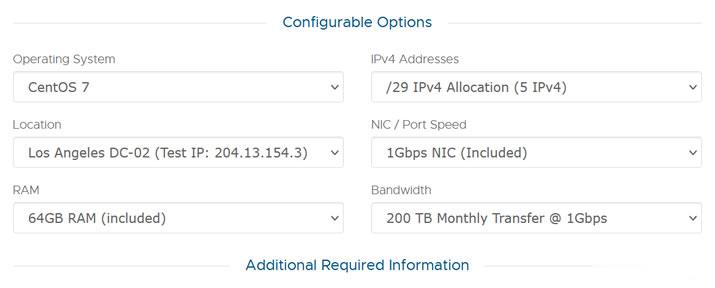

这次RackNerd商家提供的美国大硬盘独立服务器,数据中心位于洛杉矶multacom,可选Windows、Linux镜像系统,默认内存是64GB,也可升级至128GB内存,而且硬盘采用的是256G SSD系统盘+10个16TSAS数据盘,端口提供的是1Gbps带宽,每月提供200TB,且包含5个IPv4,如果有需要更多IP,也可以升级增加。CPU核心内存硬盘流量带宽价格选择2XE5-2640V2...

10gbiz七月活动首月半价$2.36/月: 香港/洛杉矶CN2 GIA VPS

10gbiz怎么样?10gbiz 美国万兆带宽供应商,主打美国直连大带宽,真实硬防。除美国外还提供线路非常优质的香港、日本等数据中心可供选择,全部机房均支持增加独立硬防。洛杉矶特色线路去程三网直连(电信、联通、移动)回程CN2 GIA优化,全天低延迟。中国大陆访问质量优秀,最多可增加至600G硬防。香港七星级网络,去程回程均为电信CN2 GIA+联通+移动,大陆访问相较其他香港GIA线路平均速度更...

MOACK:韩国服务器/双E5-2450L/8GB内存/1T硬盘/10M不限流量,$59.00/月

Moack怎么样?Moack(蘑菇主机)是一家成立于2016年的商家,据说是国人和韩国合资开办的主机商家,目前主要销售独立服务器,机房位于韩国MOACK机房,网络接入了kt/lg/kinx三条线路,目前到中国大陆的速度非常好,国内Ping值平均在45MS左右,而且商家的套餐比较便宜,针对国人有很多活动。不过目前如果购买机器如需现场处理,由于COVID-19越来越严重,MOACK办公楼里的人也被感染...

baht为你推荐

-

国际域名常用的国际顶级域名有哪些?域名主机IDC(主机域名)是什么意思?ip代理地址ip代理有什么用?海外域名怎么挑选合适的国外域名?asp虚拟空间怎样在一个虚拟空间里放上一个ASP和一个PHP的网站万网虚拟主机万网虚拟主机可以做几个网站合肥虚拟主机虚拟主机是干嘛的?买了虚拟主机是否要一台电脑?河南虚拟主机新网的虚拟主机怎么样?青岛虚拟主机虚拟主机在什么地方买好?又便宜?四川虚拟主机222.214.218.100 请问这个IP是哪个服务商提供的?