figures汇丰银行-中国廉价航空:十年繁荣的开始_行业资料_市场研究报告_6_金融保险_PPP_银行_基金私募

June2019By:David Wu (S1700518110001) www.research.hsbc.com

Disclosures&Disclaimer:Thisrepo rtm ustbereadwiththedisclosuresandtheanalystcertificatio nsintheDisclosureappendix,andwiththeDisclaimer,whichformspartofit.

Why read this report

We explain why we think China‟s low-cost carriers(LCCs)are in asweetspot;demand is set to boom as mass tourism increases andairfares become increasinglyaffordable

The outlook for the supplyside is improving, too; the easing ofaviation regulations,airport growth,and fleet expansion wi l l powergrowth in capacity

We initiate coverage on three Chinese LCCs,and we explainwhywe prefer Spri ng Airl ines(Buy)

It‟s notjustthe vastaddressable market, the size of the country, the increase in disposableincome,and t-he easing of aviation regulations thatare so appealing Whatwe real lyl ike is the

ASsosnoiaciLauteo*(S1700119030004) airfares become increasinglyaffordable The two keyindicators to watch are GDP percapitaShenzhen

easing of aviation regulations,more airport capacity,which wi l l create new fl ight slots,and themass production of a domestic aircraft

We initiate coverage on Spring Airl ines (Buy),Juneyao Airl ines (Buy)and China ExpressAi „rl ines (Buy)The‟ ir business models vary buttheyshould al l benefitfrom whatwe see as beinga golden decade forthe LCC industryinChina

1

Contents

Whyreadthisreport 1Factsandfigures 4Relatedresearch 5Agoodflightplan 6The start of a„goldendecade‟ 17The supplysideisimproving 23Companysection 29Spring Airl ines(601021CH) 30Juneyao Airl ines(603885CH) 45China Express Airl ines

(002928CH) 60Disclosureappendix 78Disclaimer 83

2

The rise of China‟s low-cost carrier

(LCC)airl ines

We bel ievethe growing popularity of mass traveland increasingly affordablef l ight tickets wi l l drivethe demandfor LCCs,whi le easingpressure on the supply side wi l l boost transport capacity We initiate coverage on Spring Airl ines, Juneyao Airl ines and China Express Airl ines

Easing pressures onthe supplyside are positive for China‟s LCCs

Revtisedflfightslotsd, timeal lotitcatti ion Matssdptrodbucti ioin o2f0t2h1e Cb919ti Oviteirthei lnlebxti lfdiveyeahrsb, ainumtberofsysemreorm,an aquan a ve expece o egn n , oos ng c esw u new u arporsorscoringsystem capacity growth expandexistingfaci l ities

Sou rce:Bu reau of Economic Analys is,HSBC Qian hai Secu rities

3

Facts and figures

LWe bel ieve the market share of LCCs in

China wi l l reach35%in 2027e

The growth in LCC passengertraffic in

China over2018-27e

T

dropped to 1 .2%of per capita disposableAverage US domestic airfareof the proportion of percapitadisposable income(1960-80)

4

Related research

Recommended reading

Chinese Airl ines:Ready for take-off, 19 January2019

HKandChinaAirl ines:Boeing737Maxgrounded:weanalysetheimpact,19March 2019

Eu ropean lowcostai rl ines:Supplyg rowthfal lsfast,dem andfal lsfaster,2April2019

Eu ropea n LCCs:Thetimes theya reacha ngi ng,27September2018

Indian Aviation:Traffic growth halts as rising fares hurt demand, 11March2019

5

Agood fl ight plan

It‟s an excel lent time to be a low-costcarrier(LCC) in China.We thinkthe industry is in a sweet spot as growth in mass tourism andincreasinglyaffordable ticket prices drive demand.The supplyside,aproblem in the past, is improving, too.We expect LCC passenger trafficto rise at a CAGR of 20%over 2018-27e,with the marketshare rising to35%.We initiate coverage on Spring Airl ines(Buy),Juneyao Airl ines(Buy)and China Express Airl ines(Buy),and we prefer Spring Airl ines.China‟s aviation industrystarted late bu‟t is catching up quickly According to the Civi l AviationAdministration of China(CAAC),China s airl ines flew a total of 610m passengers in 2018,up106%y-o-y,and second onlytothe 1 01bn passengers in the US Low-costcarriers (LCCs)onlyappeared in themarket in‟2004 By2017 theywere carrying 6224m passengers,accounting for 1 1 3%of Chinas aviation marketand pul ling in revenues of RMB3548bn

It‟s notjustthe vastaddressable market, the size of the country, the increase in disposableincome,and the easing of aviation regulations thatare so appealing Whatwe real lyl ike is thestage the industry has reached

The US and Europe provide good pointers forhowthe lowcostcarrier industrycan develop inChina These markets tel l us that LCCs startto prosperwhen flying loses the luxurycachetassociated with the wealthyand business travel The two key indicators to watch are GDP percapita and the price of airfares as a percentage of average disposable income Based on thesemetrics,we bel ieve China is in a sweetspot This reports looks at:

How industrydemand is readyto surge,ushering in a„golden decade‟ofgrowth Whypressure on thesupplyside is easing Keyfactors are the easing of aviationregulations,m oreairportcapacitywi l l reducecongestion,andm ass prod uctionofadom estic aircraftwi l l boostcapacity

The prospects forthe three LCCs on which we initiate coverage–Spring Airl ines(Buy),JuneyaoAirl ines (Buy)and China Express Airl ines (Buy)We explain whywe preferSpringAi rl i nes

6

Exhibit 1.Comps table

Company Ticker LCY CloPsirnigce ADTV MaCrkaept PE(x) _PB(x) ROE(%) CAGRE(%PS) Divyi(e%ld)

Average 17.1 15.9 11.6 2.2 2.0 1.7 15 13 16 24 1ASomuethrwiceasntAaivrliianteiosn compaLnUieVsUS

JetBlueAirwa s JBLUUS USD 419761 1561 48 2529 10939 975 8685 21 20 01 89 01 57 2141 2142 2123 691 01S iritAirl inesy SAVEUS USD 468 329 32 83 74 67 1 4 1 1 09 18 16 15 43 0

Globalaverage 11.5 12.1 9.9 2.4 2.1 1.8 15 18 19 19 2CReomiopnaarlisaoirlninfeosrinreCghioinnaal airl ines

C

Note:Priced at close of 29 May 2019 NA–Notapplicable Source:Bloomberg,HSBC Qianhai Securities estimates(*Stocks we cover in the report)

Source:CAAC,NationalBureauofStatistics,WorldBank,HSBCQianhaiSecurities Source:CAAC,NationalBureauofStatistics,WorldBank,HSBCQianhaiSecurities

Abusiness modelemphasising costreduction and efficiency

Compared to ful l-service carriers,LCCs reduce theircosts and improve operational efficiencybyeithersimpl ifying ornotoffering services (e g,baggage drop-off, in-fl ightmeals and in-fl ightentertainment)The LCC business model was started in the 1970s bythe American domesticcarrier,SouthwestAirl ines(LUVUS,Not Rated),now the largestof its kind The model wassoon adopted in othermarkets and LCCs now have a marketshare of between 30%and 40%in

7

the US,Europe and Asia Pacific China‟s LCCs include Spring Airl ines,JuneyaoAirl ines,ChinaUnited Airl ines,WestAir,Capital Airl ines and Chengdu Airl inescExonhtibinite4nt.2017 marketshare of LCCs by Exhibit5.Marketshare of LCCs in China

Ful l-serviceCarriers Lost-costCarriers Others

Source:Airbus,HSBCQianhaiSecurities Source:CAAC,Wind,HSBC QianhaiSecurities

Operational differences between LCCs and full-service carriers include:

Single aircrafttype: this cuts purchase costs and makes maintenance cheaperandeasier High passenger load factor (PLF)and aircraft uti l isation rate: to amortise fixed costs byincreasing carrying capacityand aircraftdai lyfl ightslots

Low ticket prices and sell ing expenses:high ratio of direct sales;bui lding self-managedsales channels to reduce agencyfees;attracting consumers with lowerticket prices Due tolongeraverage fl ightdistances,LCCs in China have lowered fares based on the scaleeffe ct

Point-to-point fl ight route: focus on major airports,different from the hub-and-spoke routenetwork of ful l-serviceairl ines

Low staff-aircraft ratio:strict control over the num ber of non-frontl ine em ployees;emphasison staff efficiency improvement and economies ofscale

High proportion of anci l laryrevenue: tap potential demand from consumers,expand fee-based services other than passenger and freight to im proveprofitabi lity

High profitabil ity:bysqueezing costs,enhancing efficiencyand strengtheningmanagement, top-performing LCCs often achieve higherprofitmargins than traditionalcarriers

8

- figures汇丰银行-中国廉价航空:十年繁荣的开始_行业资料_市场研究报告_6_金融保险_PPP_银行_基金私募相关文档

- 卡特跨国巨头对中国行业龙头展开廉价掠夺式并购行业经济论文

- 合同个人廉价租房合同新编标准范本

- 报告上海廉价酒店考察报告标准范本

- 廉价vps除了搬瓦工还有哪些vps适合新手,便宜又方便

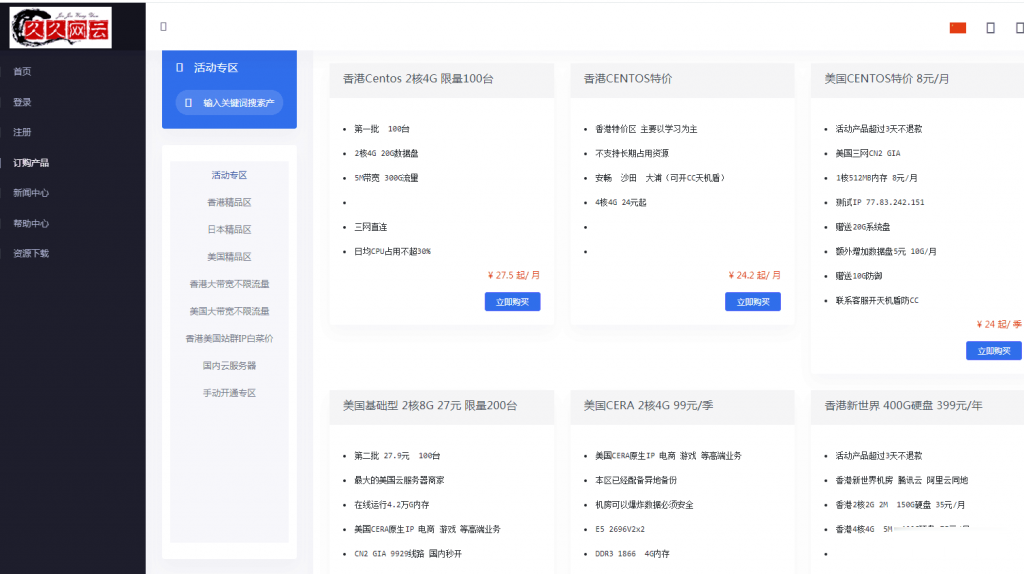

久久网云-目前最便宜的国内,香港,美国,日本VPS云服务器19.9元/月起,三网CN2,2天内不满意可以更换其他机房机器,IP免费更换!。

久久网云怎么样?久久网云好不好?久久网云是一家成立于2017年的主机服务商,致力于为用户提供高性价比稳定快速的主机托管服务,久久网云目前提供有美国免费主机、香港主机、韩国服务器、香港服务器、美国云服务器,香港荃湾CN2弹性云服务器。专注为个人开发者用户,中小型,大型企业用户提供一站式核心网络云端服务部署,促使用户云端部署化简为零,轻松快捷运用云计算!多年云计算领域服务经验,遍布亚太地区的海量节点为...

无忧云:洛阳BGP云服务器低至38.4元/月起;雅安高防云服务器/高防物理机优惠

无忧云怎么样?无忧云,无忧云是一家成立于2017年的老牌商家旗下的服务器销售品牌,现由深圳市云上无忧网络科技有限公司运营,是正规持证IDC/ISP/IRCS商家,主要销售国内、中国香港、国外服务器产品,线路有腾讯云国外线路、自营香港CN2线路等,都是中国大陆直连线路,非常适合免备案建站业务需求和各种负载较高的项目,同时国内服务器也有多个BGP以及高防节点。一、无忧云官网点击此处进入无忧云官方网站二...

创梦网络-江苏宿迁BGP云服务器100G高防资源,全程ceph集群存储,安全可靠,数据有保证,防护真实,现在购买7折促销,续费同价!

官方网站:点击访问创梦网络宿迁BGP高防活动方案:机房CPU内存硬盘带宽IP防护流量原价活动价开通方式宿迁BGP4vCPU4G40G+50G20Mbps1个100G不限流量299元/月 209.3元/月点击自助购买成都电信优化线路8vCPU8G40G+50G20Mbps1个100G不限流量399元/月 279.3元/月点击自助购买成都电信优化线路8vCPU16G40G+50G2...

-

互联网周鸿祎SCProute水土保持ios8支持ipad支持ipad支持ipad敬请参阅报告结尾处免责声明C1:山东品牌商品馆win7如何关闭445端口如何关闭445端口,禁用smb协议phpemptyphp中 isset函数有什么功能